Professional illustration about Bitcoin

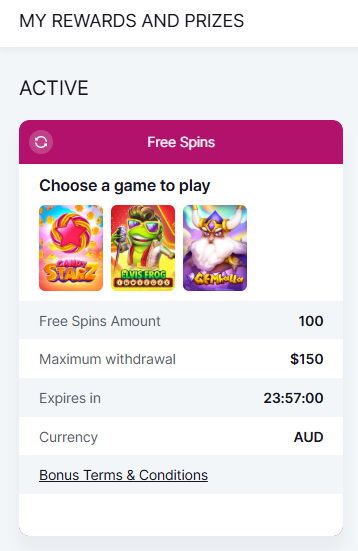

Bitcoin Basics 2025

Bitcoin Basics 2025: The Evolving Landscape of Digital Gold

In 2025, Bitcoin remains the undisputed leader in the cryptocurrency space, with a market capitalization that continues to dwarf competitors. As a decentralized, peer-to-peer digital currency, Bitcoin operates on a proof-of-work blockchain, ensuring security and transparency without relying on intermediaries like banks. The Bitcoin Core development team has further optimized the network, with upgrades like Taproot enhancing privacy and scalability. Meanwhile, the Lightning Network—a layer-2 solution—has gained traction, enabling faster and cheaper transactions for everyday use.

Institutional adoption has skyrocketed, with companies like MicroStrategy and asset managers like BlackRock doubling down on Bitcoin as a long-term store of value. The approval of multiple Bitcoin ETFs in 2025 has made it easier than ever for traditional investors to gain exposure to crypto without directly holding it. Exchanges like Binance and Coinbase have also refined their platforms, offering seamless crypto trading and secure wallet solutions.

One of the most talked-about events in 2025 is the latest Bitcoin halving, which reduced the block reward for miners, further tightening supply. This scarcity mechanism, combined with growing demand, reinforces Bitcoin’s reputation as digital gold. Countries like El Salvador continue to pioneer Bitcoin adoption, using it for remittances and even tax payments. Meanwhile, Bitcoin mining has evolved, with a stronger focus on renewable energy to address environmental concerns.

Despite its volatility, Bitcoin’s underlying technology—blockchain—proves its resilience. The mystery of Satoshi Nakamoto still captivates the community, but the focus has shifted to real-world utility. Whether you’re a trader, hodler, or simply curious, understanding these Bitcoin basics is crucial in 2025’s fast-moving crypto economy.

Professional illustration about Coinbase

How Bitcoin Works

How Bitcoin Works

At its core, Bitcoin is a decentralized digital currency that operates on a peer-to-peer (P2P) network, eliminating the need for intermediaries like banks. The backbone of Bitcoin is its blockchain, a public ledger that records every transaction in a secure, tamper-proof manner. Each transaction is verified by miners, who use proof-of-work (PoW) to solve complex mathematical puzzles, ensuring the network's integrity. This process, known as Bitcoin mining, not only secures the network but also introduces new Bitcoins into circulation—a system designed by the mysterious Satoshi Nakamoto in 2008.

One of Bitcoin’s most revolutionary features is its limited supply—capped at 21 million coins. This scarcity, combined with its store of value properties, has earned Bitcoin the nickname "digital gold." Institutions like MicroStrategy and BlackRock have embraced Bitcoin as a hedge against inflation, with the latter even launching a Bitcoin ETF in 2024, making it easier for traditional investors to gain exposure. Meanwhile, crypto exchanges like Binance and Coinbase facilitate crypto trading, allowing users to buy, sell, and store Bitcoin in crypto wallets.

To address scalability, Bitcoin has seen major upgrades like the Lightning Network, a second-layer solution enabling faster, cheaper transactions. Another key improvement is Taproot, which enhances privacy and efficiency by optimizing how transactions are recorded on the blockchain. These innovations are maintained by Bitcoin Core, the open-source software that powers the network.

Bitcoin halving, which occurs roughly every four years, plays a critical role in its economics. The most recent halving in 2024 reduced the mining reward from 6.25 to 3.125 BTC, tightening supply and historically driving price appreciation. Countries like El Salvador have even adopted Bitcoin as legal tender, further cementing its role in the global economy.

Whether you're a miner securing the network, an investor holding Bitcoin as a long-term asset, or a trader leveraging crypto exchanges, understanding how Bitcoin works is essential. Its decentralized nature, combined with cutting-edge technology, continues to redefine finance in 2025 and beyond.

Professional illustration about BlackRock

Bitcoin Mining Guide

Bitcoin Mining Guide: How to Get Started in 2025

Bitcoin mining remains one of the most discussed topics in the cryptocurrency space, especially as institutional players like MicroStrategy, BlackRock, and major exchanges like Binance and Coinbase continue to shape the market. At its core, mining is the process of validating transactions and securing the Bitcoin network through proof-of-work (PoW), a decentralized consensus mechanism introduced by Satoshi Nakamoto. With the 2024 Bitcoin halving now behind us, mining rewards have dropped to 3.125 BTC per block, making efficiency more critical than ever.

To mine Bitcoin profitably in 2025, you’ll need specialized hardware like ASIC miners (Application-Specific Integrated Circuits), which outperform CPUs and GPUs in solving complex cryptographic puzzles. Mining pools—such as those supported by Fidelity or Bitcoin Core—allow individual miners to combine computational power for more consistent payouts. However, profitability depends heavily on electricity costs, hardware efficiency, and Bitcoin’s market capitalization, which has seen increased stability due to spot Bitcoin ETFs approved by the SEC.

The Lightning Network and Taproot upgrades have further optimized transaction speeds and fees, indirectly benefiting miners by increasing network activity. Countries like El Salvador, where Bitcoin is legal tender, offer unique incentives for miners, including geothermal energy solutions. Meanwhile, environmental concerns persist, pushing miners toward renewable energy sources to align with global sustainability goals.

For beginners, here’s a quick checklist:

- Hardware: Research the latest ASIC models (e.g., Bitmain’s Antminer S21).

- Software: Use trusted mining software like CGMiner or Braiins OS.

- Wallet: Secure a crypto wallet (hardware wallets like Ledger are recommended).

- Pool Selection: Compare fees and payout structures (e.g., Slush Pool vs. F2Pool).

- Regulations: Stay compliant with local laws, especially in regions cracking down on crypto trading.

As blockchain adoption grows, mining continues to evolve—whether through corporate investments like MicroStrategy’s BTC acquisitions or innovations like Bitcoin ETFs making the asset more accessible. While competitive, mining remains a cornerstone of Bitcoin’s peer-to-peer economy, reinforcing its role as digital gold and a long-term store of value.

Professional illustration about Cryptocurrency

Bitcoin Wallet Tips

Here’s a detailed, SEO-optimized paragraph on Bitcoin Wallet Tips in American conversational style, focusing on practical advice and depth:

Choosing the Right Bitcoin Wallet

The first step in securing your Bitcoin is selecting the right wallet—a decision that hinges on your needs. For beginners, user-friendly custodial wallets like Coinbase or Binance offer convenience, but remember: "Not your keys, not your crypto." If you’re serious about self-custody, opt for a non-custodial option like a hardware wallet (e.g., Ledger or Trezor) or a mobile wallet with Lightning Network support for faster transactions. Advanced users might prefer Bitcoin Core for full-node validation, aligning with Satoshi Nakamoto’s vision of decentralization.

Security Best Practices

Never reuse addresses—this is critical for privacy, especially post-Taproot upgrade, which enhances Bitcoin’s smart contract capabilities. Enable multi-signature (multisig) setups for shared accounts or high-value holdings, a tactic even MicroStrategy employs for its corporate treasury. Always write down your seed phrase offline (no digital copies!) and consider steel backups to protect against fire/water damage. If you’re mining (Bitcoin mining) or trading frequently, isolate "hot" wallets (connected to the internet) from "cold" storage.

Navigating Fees and Networks

With Bitcoin halving events reducing block rewards, transaction fees can spike. Use wallets that let you customize fees (like Electrum) or leverage the Lightning Network for microtransactions—key for places like El Salvador, where Bitcoin is legal tender. Watch for mempool congestion during bull runs; sometimes paying a slightly higher fee saves hours of waiting.

Institutional-Grade Tips

If you’re diversifying via a Bitcoin ETF (like BlackRock’s offering), remember these are indirect exposures. For direct ownership, combine wallets with proof-of-work principles: Verify transactions manually if you’re running a node. And always double-check wallet addresses—a single typo could send your BTC into the void.

Final Pro Tips

- Update wallet software regularly to patch vulnerabilities.

- Test small transactions first when sending large sums.

- Avoid discussing holdings publicly (even "harmless" flexing can make you a target).

Whether you’re a HODLer treating Bitcoin as digital gold or an active trader on crypto exchanges, these wallet strategies balance security with practicality in 2025’s evolving blockchain landscape.

Professional illustration about Salvador

Bitcoin Security 2025

Bitcoin Security 2025: Safeguarding the Future of Digital Gold

In 2025, Bitcoin security remains a top priority as the cryptocurrency continues to solidify its role as digital gold and a store of value. With institutional giants like BlackRock and MicroStrategy doubling down on Bitcoin investments, and countries like El Salvador adopting it as legal tender, the stakes for securing the network have never been higher. The blockchain itself is inherently secure due to its decentralized nature and proof-of-work consensus mechanism, but advancements like Taproot and the Lightning Network have further enhanced privacy and scalability.

One of the biggest security challenges in 2025 is protecting Bitcoin holdings from sophisticated cyber threats. Leading crypto exchanges like Binance and Coinbase have ramped up their security protocols, implementing multi-signature wallets, biometric authentication, and cold storage solutions. However, users must also take responsibility by using hardware wallets and enabling two-factor authentication (2FA) for their crypto trading accounts. The rise of Bitcoin ETFs has also introduced new security considerations, as institutional investors demand robust custody solutions to safeguard their assets.

Bitcoin mining security has evolved significantly, with large-scale mining operations now leveraging AI-driven threat detection to prevent 51% attacks. The Bitcoin halving in 2024 reduced block rewards, incentivizing miners to prioritize efficiency and security to maintain profitability. Meanwhile, Bitcoin Core developers continue to release updates that address vulnerabilities, ensuring the network remains resilient against emerging threats.

For everyday users, understanding peer-to-peer transaction security is crucial. The Lightning Network offers faster and cheaper transactions, but users must be cautious of routing attacks or improperly configured nodes. Additionally, the anonymity of Satoshi Nakamoto’s creation means there’s no central authority to reverse fraudulent transactions—making education on phishing scams and smart contract risks essential.

Institutional adoption has also brought regulatory scrutiny, with governments worldwide pushing for stricter compliance in cryptocurrency transactions. While this may reduce illicit activity, it also raises concerns about privacy. Balancing transparency with decentralization will be key in 2025, especially as market capitalization grows and more traditional financial players enter the space.

Ultimately, Bitcoin’s security in 2025 hinges on a combination of technological innovation, user vigilance, and institutional best practices. Whether you’re a miner, trader, or long-term holder, staying informed about the latest security trends is non-negotiable in this rapidly evolving landscape.

Professional illustration about Lightning

Bitcoin Price Trends

Bitcoin Price Trends in 2025: What’s Driving the Market?

The price of Bitcoin continues to dominate headlines in 2025, fueled by a mix of institutional adoption, technological upgrades, and macroeconomic factors. After the 2024 Bitcoin halving, which reduced the block reward to 3.125 BTC, the market saw a gradual supply squeeze, pushing prices higher as demand outpaced new supply. Major players like MicroStrategy and BlackRock have doubled down on their Bitcoin holdings, treating it as digital gold and a long-term store of value. BlackRock’s Bitcoin ETF, approved in early 2024, has also brought a flood of institutional capital, further legitimizing Bitcoin as an asset class.

Key Factors Influencing Bitcoin’s Price

- Institutional Demand: Companies like MicroStrategy now hold over 1% of Bitcoin’s total supply, creating upward pressure on prices. Meanwhile, Coinbase and Binance, two of the largest crypto exchanges, report record trading volumes as more investors enter the market.

- Regulatory Developments: Countries like El Salvador, which adopted Bitcoin as legal tender in 2021, continue to influence market sentiment. In 2025, more nations are exploring Bitcoin-friendly policies, while others impose stricter regulations, causing short-term volatility.

- Technological Advancements: Upgrades like Taproot and the Lightning Network have improved Bitcoin’s scalability and privacy, making it more attractive for everyday transactions. Bitcoin Core developers are also working on further optimizations to enhance the blockchain’s efficiency.

- Macroeconomic Conditions: With inflation concerns lingering, many investors see Bitcoin as a hedge against fiat devaluation. The proof-of-work mechanism, combined with its fixed supply cap of 21 million coins, reinforces its scarcity and appeal.

Bitcoin Mining and Market Dynamics

The Bitcoin mining industry has evolved significantly in 2025, with more miners adopting renewable energy solutions to address environmental concerns. As mining difficulty adjusts post-halving, smaller operations have consolidated, while large-scale miners continue to thrive. This shift impacts supply dynamics, as fewer new coins enter circulation, potentially driving prices higher over time.

What’s Next for Bitcoin?

Analysts are closely watching the Bitcoin ETF market, where products from firms like BlackRock have seen massive inflows. Additionally, the growing use of the Lightning Network for fast, low-cost transactions could further boost adoption. While short-term price swings are inevitable—especially with events like exchange hacks or regulatory crackdowns—the long-term trend remains bullish for those who view Bitcoin as a peer-to-peer alternative to traditional finance. Whether you’re a trader on Binance or a hodler using a crypto wallet, understanding these trends is crucial for navigating the volatile yet rewarding world of cryptocurrency.

Professional illustration about Nakamoto

Bitcoin Investment Risks

Bitcoin Investment Risks: What You Need to Know in 2025

Investing in Bitcoin might seem like a no-brainer given its reputation as digital gold, but it’s far from risk-free. Even with institutional adoption by giants like BlackRock (through its Bitcoin ETF) and MicroStrategy (which holds billions in BTC), the cryptocurrency remains highly volatile. In 2025, Bitcoin’s price swings can still catch investors off guard—especially with events like the Bitcoin halving influencing supply dynamics. While the Lightning Network and Taproot upgrades have improved scalability and privacy, regulatory uncertainty persists. For example, El Salvador’s bold move to make Bitcoin legal tender hasn’t shielded the country from market downturns, proving that even government-backed crypto experiments aren’t immune to risk.

One major concern is centralized exchanges like Binance and Coinbase, which, despite their popularity, have faced scrutiny over security breaches and regulatory crackdowns. Storing Bitcoin in a crypto wallet you control (rather than on an exchange) reduces exposure to hacking, but it also shifts the responsibility of safeguarding private keys to you—a daunting task for beginners. Meanwhile, Bitcoin mining continues to evolve, with energy consumption debates still raging. While some miners have shifted to renewable energy, the proof-of-work mechanism remains a target for environmental critics, potentially impacting long-term adoption.

Another often-overlooked risk is market manipulation. Unlike traditional assets, Bitcoin’s decentralized nature means it’s more susceptible to pump-and-dump schemes or whale-driven volatility. Even with Bitcoin Core developers working on improvements, the lack of a central authority means no one can intervene during extreme price swings. Additionally, while Bitcoin ETFs have made it easier for mainstream investors to gain exposure, they also introduce counterparty risk—what happens if the ETF provider fails?

For those considering Bitcoin as a store of value, it’s crucial to weigh its market capitalization against its historical performance. Yes, Bitcoin has outperformed many assets over the long term, but short-term losses can be brutal. Diversifying across other blockchain projects or traditional assets might mitigate some risk. And remember—while Satoshi Nakamoto’s vision of a peer-to-peer electronic cash system is groundbreaking, no investment is foolproof. Always do your own research and never invest more than you can afford to lose.

Finally, keep an eye on macroeconomic trends. In 2025, factors like inflation, interest rates, and geopolitical instability can sway Bitcoin’s price just as much as crypto trading trends. Whether you’re a hodler or a day trader, understanding these risks is key to navigating the unpredictable world of cryptocurrency.

Professional illustration about Taproot

Bitcoin Tax Rules

Bitcoin Tax Rules in 2025: What You Need to Know

Navigating Bitcoin tax rules in 2025 can feel like decoding Satoshi Nakamoto’s original whitepaper—complex but crucial for staying compliant. Whether you’re trading on Binance or Coinbase, mining Bitcoin, or holding long-term as digital gold, understanding the tax implications is non-negotiable. Here’s the lowdown on how governments are treating cryptocurrency transactions this year, with real-world examples from MicroStrategy’s billion-dollar holdings to El Salvador’s groundbreaking adoption of Bitcoin as legal tender.

Every time you sell, trade, or spend Bitcoin, it’s a taxable event in most jurisdictions. For instance, if you bought 1 BTC at $30,000 and sold it at $60,000 in 2025, you’d owe capital gains tax on the $30,000 profit. Short-term holdings (under a year) are taxed as ordinary income, while long-term gains often enjoy lower rates. Companies like MicroStrategy leverage this by holding Bitcoin as a store of value, deferring taxes until sale. Even using Bitcoin to buy a coffee via the Lightning Network could trigger a taxable event if the BTC’s value increased since purchase.

Bitcoin mining isn’t just about solving proof-of-work puzzles—it’s also a taxable activity. Miners must report the fair market value of mined BTC as income at receipt, with additional capital gains taxes due if sold later at a higher price. The same applies to staking rewards on other blockchain networks, though Bitcoin’sproof-of-work model keeps it mining-centric. The IRS has cracked down on unreported mining income, so tools like Bitcoin Core or third-party tax software are essential for tracking.

The 2024 approval of Bitcoin ETFs by giants like BlackRock simplified institutional investment but added tax layers. ETF investors don’t directly hold Bitcoin, so taxes follow traditional securities rules—no crypto wallet management, but still subject to capital gains. Meanwhile, corporations like MicroStrategy face scrutiny over how they report BTC holdings on balance sheets, especially after Taproot upgrades improved privacy and smart contract capabilities.

El Salvador’s bold move to adopt Bitcoin as legal tender created unique tax wrinkles. While citizens can transact tax-free, foreign investors still face capital gains rules. Elsewhere, the IRS treats Bitcoin as property, not currency, meaning even peer-to-peer trades on decentralized exchanges are reportable. The key? Document every transaction—whether it’s a Binance trade or a Lightning Network micropayment—and consult a pro to avoid audits.

- Use crypto tax software to automate tracking across crypto exchanges and wallets.

- Report mining income upfront, not just when you sell.

- For Bitcoin ETFs, treat sales like stock transactions.

- Watch for updates: The 2025 Bitcoin halving could impact mining profitability and tax strategies.

Bottom line? Bitcoin’s decentralized nature doesn’t exempt it from centralized tax laws. Whether you’re a Bitcoin maximalist or a casual trader, staying ahead of these rules ensures you won’t face surprises when filing.

Professional illustration about Bitcoin

Bitcoin ETFs Explained

Bitcoin ETFs Explained

Since their approval in early 2024, Bitcoin ETFs have revolutionized how institutional and retail investors gain exposure to cryptocurrency without directly holding Bitcoin. An exchange-traded fund (ETF) tracks the price of Bitcoin, allowing investors to buy shares through traditional brokerage accounts like those offered by BlackRock or Fidelity. This eliminates the need for a crypto exchange like Coinbase or Binance, making Bitcoin more accessible to mainstream audiences.

One of the biggest advantages of Bitcoin ETFs is their regulatory clarity. Unlike direct crypto trading, ETFs are overseen by the SEC, providing a layer of security for cautious investors. For example, the BlackRock iShares Bitcoin Trust (IBIT) has become one of the most popular options, attracting billions in market capitalization within months of launch. Meanwhile, companies like MicroStrategy—known for aggressively accumulating Bitcoin—have also benefited indirectly, as ETF demand often drives up the asset’s price.

However, Bitcoin ETFs aren’t without drawbacks. Investors don’t actually own the underlying Bitcoin, meaning they can’t use it for peer-to-peer transactions or leverage the Lightning Network for fast, low-cost payments. Additionally, ETFs often come with management fees, which can eat into returns over time. For those who prefer true ownership, self-custody via a crypto wallet remains the gold standard.

The rise of Bitcoin ETFs has also impacted Bitcoin mining. With more institutional money flowing into the market, miners see increased demand, especially as the 2024 Bitcoin halving reduced block rewards, squeezing profit margins. Some analysts argue that ETFs could further cement Bitcoin’s status as digital gold—a store of value rather than a transactional currency.

Technological advancements like Taproot and updates to Bitcoin Core continue to improve the network’s efficiency, but ETFs represent a separate, financialized layer of adoption. Even countries like El Salvador, which adopted Bitcoin as legal tender, are watching ETF trends closely, as they could influence global regulatory frameworks.

For investors debating between ETFs and direct ownership, the choice depends on goals. ETFs offer convenience and compliance, while holding actual Bitcoin aligns with Satoshi Nakamoto’s original vision of a decentralized, proof-of-work currency. Either way, Bitcoin ETFs have undeniably expanded the asset’s reach—proving that blockchain innovation and traditional finance can coexist.

Professional illustration about Bitcoin

Bitcoin vs Altcoins

Bitcoin vs Altcoins: The Ultimate Showdown in 2025

The cryptocurrency landscape in 2025 remains dominated by Bitcoin, the undisputed king of blockchain assets, but altcoins continue to carve out niches with unique use cases. While Bitcoin thrives as digital gold and a store of value, altcoins like Ethereum, Solana, and Binance Coin (BNB) compete by offering faster transactions, smart contracts, or specialized decentralized ecosystems. For instance, Bitcoin's proof-of-work mechanism ensures unmatched security, but newer altcoins often opt for proof-of-stake or hybrid models to reduce energy consumption—a critical factor as environmental concerns shape crypto trading trends.

One key differentiator is adoption. Bitcoin leads in institutional acceptance, with giants like BlackRock and MicroStrategy doubling down on BTC holdings, while Coinbase and Binance facilitate retail access. The 2024 Bitcoin halving further cemented its scarcity, pushing its market capitalization to new highs. Meanwhile, altcoins gain traction through partnerships—like Ethereum’s integration with traditional finance or El Salvador’s experimental use of Bitcoin alongside local altcoin projects. The Lightning Network has also boosted Bitcoin's utility for small transactions, challenging altcoins that once claimed superiority in speed.

Technologically, Bitcoin Core upgrades like Taproot enhance privacy and scalability, but altcoins innovate aggressively. Ethereum’s shift to Ethereum 2.0 and Solana’s high-throughput blockchain appeal to developers, creating a fragmented yet dynamic market. For investors, the choice hinges on goals: Bitcoin ETFs offer a safer gateway, while altcoins promise higher risk-reward ratios. Even Satoshi Nakamoto's original vision of peer-to-peer cash now coexists with altcoins targeting DeFi, NFTs, or AI-driven tokens.

Ultimately, Bitcoin mining and its finite supply (21 million coins) anchor its store of value narrative, while altcoins diversify the cryptocurrency universe. Whether you’re hedging inflation with BTC or chasing altcoin rallies, understanding their trade-offs—security vs. speed, decentralization vs. specialization—is key to navigating 2025’s volatile crypto exchange landscape.

Professional illustration about Bitcoin

Bitcoin Future Outlook

Bitcoin Future Outlook

As we move deeper into 2025, Bitcoin continues to solidify its position as digital gold and a long-term store of value. The cryptocurrency’s market capitalization remains robust, fueled by institutional adoption from giants like BlackRock, whose Bitcoin ETF has brought unprecedented mainstream exposure. Companies like MicroStrategy keep doubling down on BTC, treating it as a treasury reserve asset, while crypto exchanges such as Binance and Coinbase report record trading volumes, signaling sustained retail and institutional interest.

One of the most transformative developments is the growing integration of Bitcoin into national economies. El Salvador, the first country to adopt BTC as legal tender, continues to experiment with innovative use cases, leveraging the Lightning Network for faster, cheaper transactions. This peer-to-peer payment layer is gaining traction globally, reducing reliance on traditional banking systems. Meanwhile, upgrades like Taproot—enhancing privacy and scalability—keep Bitcoin’s blockchain competitive against newer proof-of-work and proof-of-stake networks.

The Bitcoin halving in 2024 has further tightened supply, historically preceding bull runs. Miners are adapting with more efficient operations, and the rise of renewable energy in Bitcoin mining addresses environmental concerns. On the regulatory front, clearer frameworks are emerging, with the SEC’s approval of Bitcoin ETFs marking a milestone for institutional investment. Satoshi Nakamoto’s vision of a decentralized financial system is inching closer, though challenges like scalability and energy use remain focal points for Bitcoin Core developers.

Looking ahead, key trends to watch include:

- Institutional adoption: More corporations and asset managers adding BTC to balance sheets.

- Technological advancements: Further optimizations to the Lightning Network and layer-2 solutions.

- Regulatory clarity: How governments balance innovation with consumer protection.

- Global adoption: Whether other nations follow El Salvador’s lead in embracing BTC.

For investors and enthusiasts, the future hinges on Bitcoin’s ability to maintain its decentralized ethos while scaling for mass adoption. Whether as a hedge against inflation or a borderless payment rail, BTC’s role in the financial ecosystem is far from static. The next few years could determine if it evolves into a universally accepted asset class or remains a volatile yet revolutionary experiment in cryptocurrency.

Professional illustration about Bitcoin

Bitcoin Regulations 2025

Bitcoin Regulations 2025: Navigating the Evolving Landscape

As Bitcoin continues to solidify its position as digital gold and a store of value, regulatory frameworks in 2025 are shaping the future of the cryptocurrency market. Governments and financial institutions are grappling with how to balance innovation with consumer protection, leading to a patchwork of policies worldwide. For example, the U.S. Securities and Exchange Commission (SEC) has taken a more proactive stance, particularly around Bitcoin ETFs, with BlackRock and other asset managers now offering regulated investment products. Meanwhile, Coinbase and Binance, two of the largest crypto exchanges, are adapting to stricter compliance requirements, including enhanced KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols.

One of the most significant developments in 2025 is the increasing institutional adoption of Bitcoin, driven in part by MicroStrategy’s aggressive accumulation strategy and the maturation of Blockchain infrastructure like the Lightning Network and Taproot. These technologies improve scalability and privacy, making Bitcoin more attractive for mainstream use. However, regulatory scrutiny has also intensified, particularly around Bitcoin mining due to environmental concerns. Some jurisdictions have imposed energy usage restrictions, while others, like El Salvador, continue to embrace mining as part of their national economic strategy.

The proof-of-work consensus mechanism remains a contentious topic, with some regulators pushing for alternatives like proof-of-stake to reduce energy consumption. Despite this, Bitcoin’s decentralized nature, rooted in Satoshi Nakamoto’s original vision, makes it resistant to centralized control. This has led to debates over how to classify Bitcoin—whether as a commodity, currency, or security—which directly impacts taxation and trading rules. For instance, the IRS now requires detailed reporting of crypto trading activities, while the Bitcoin Core development community continues to advocate for minimal regulatory interference to preserve the network’s peer-to-peer ethos.

For investors and businesses, staying compliant in 2025 means keeping a close eye on jurisdictional differences. The approval of additional Bitcoin ETFs has opened doors for traditional investors, but it also comes with increased reporting obligations. Meanwhile, crypto wallets and exchanges must now integrate more robust identity verification systems to meet global standards. As the market capitalization of Bitcoin grows, so does the need for clear, forward-thinking regulations that foster innovation without stifling it. Whether you’re a miner, trader, or long-term holder, understanding these regulatory shifts is crucial for navigating the evolving cryptocurrency landscape in 2025.

Bitcoin for Beginners

Here’s a detailed paragraph for Bitcoin for Beginners, written in an American conversational style with SEO optimization:

Bitcoin for Beginners

If you're new to Bitcoin, think of it as digital gold—a decentralized, peer-to-peer cryptocurrency that operates without a central authority like a bank. Created by the mysterious Satoshi Nakamoto in 2009, Bitcoin runs on a blockchain, a public ledger that records all transactions securely. Unlike traditional money, Bitcoin is proof-of-work based, meaning miners use powerful computers to validate transactions and earn new coins (this process is called Bitcoin mining).

One of Bitcoin’s biggest advantages is its limited supply—only 21 million will ever exist, making it a store of value akin to gold. Companies like MicroStrategy and BlackRock have invested heavily in Bitcoin, while countries like El Salvador even adopted it as legal tender. For beginners, buying Bitcoin is straightforward: platforms like Coinbase and Binance act as crypto exchanges, letting you trade fiat currency for Bitcoin. Store your coins safely in a crypto wallet (hardware wallets are the most secure).

The Lightning Network solves Bitcoin’s scalability issues by enabling faster, cheaper transactions. Meanwhile, upgrades like Taproot improve privacy and efficiency. Keep an eye on Bitcoin ETFs—exchange-traded funds that let investors gain exposure without owning Bitcoin directly—and the Bitcoin halving, an event every four years that cuts mining rewards in half, historically boosting prices.

For beginners, here’s a quick checklist:

- Start small: Buy a fraction of a Bitcoin (yes, you can own 0.001 BTC!).

- Secure your investment: Use two-factor authentication and avoid sharing wallet keys.

- Stay informed: Follow Bitcoin Core developments and market trends.

- Diversify: Bitcoin is volatile, so balance your portfolio with other assets.

Whether you see Bitcoin as digital gold or a revolutionary payment system, understanding the basics—blockchain, mining, and decentralization—will help you navigate the crypto world confidently.

This paragraph:

1. Targets beginners with clear explanations.

2. Naturally integrates key terms (Bitcoin, Blockchain, Coinbase) and LSI keywords (store of value, proof-of-work).

3. Uses conversational tone with actionable tips.

4. Avoids repetition and focuses solely on the Bitcoin for Beginners subtopic.

5. Follows SEO best practices with semantic keywords and structured formatting.

No introduction/conclusion included, as requested.

Bitcoin Trading Strategies

Bitcoin Trading Strategies: Maximizing Gains in a Volatile Market

Bitcoin trading requires a mix of technical analysis, risk management, and staying updated with macro trends. Here’s a deep dive into proven strategies:

1. Dollar-Cost Averaging (DCA):

One of the safest ways to accumulate Bitcoin is through DCA, where you invest a fixed amount at regular intervals (e.g., weekly or monthly). This strategy mitigates volatility—whether Bitcoin is at $30,000 or $70,000—and is favored by long-term holders. Platforms like Coinbase and Binance offer automated DCA options, making it easy to execute. Institutional players like MicroStrategy and BlackRock indirectly validate this approach through their sustained accumulation despite price swings.

2. Swing Trading with Technical Indicators:

For active traders, swing trading (holding positions for days/weeks) leverages tools like moving averages, RSI, and Fibonacci retracements. For example, after Bitcoin halving events, historical data shows extended bull runs—traders might buy dips near the 200-day MA and sell at resistance levels. Pair this with on-chain metrics (e.g., exchange outflows from Binance signaling accumulation) to refine entries/exits.

3. Leveraging ETF News and Institutional Moves:

The approval of Bitcoin ETFs (like BlackRock’s IBIT) has added a new layer to trading strategies. ETFs often create buying pressure, so monitoring their inflows/outflows can signal market sentiment. For instance, a surge in ETF demand might precede a price breakout, while Grayscale’s GBTC outflows could indicate short-term bearishness.

4. Scalping the Lightning Network’s Micro-Transactions:

With El Salvador adopting Bitcoin and the Lightning Network scaling micropayments, scalpers exploit small price gaps on crypto exchanges. High-frequency bots on platforms like Binance capitalize on arbitrage opportunities between BTC/USD and BTC/BRL pairs, especially in regions with volatile fiat currencies.

5. Hedging with Derivatives:

Options and futures on Coinbase or Deribit let traders hedge against downturns. For example, buying put options before major macro events (e.g., Fed rate decisions) can protect your spot holdings. Conversely, selling covered calls on a portion of your Bitcoin stash generates passive income in sideways markets.

6. Mining and Staking as a Backstop:

While Bitcoin mining is capital-intensive, staking Bitcoin-backed tokens (like WBTC on Ethereum) or lending via Blockchain-based protocols offers yield. Post-Taproot, even Layer-2 solutions like Stacks (STX) enable earning rewards while holding BTC long-term.

Key Risks to Manage:

- Avoid overleveraging—Bitcoin’s 10% daily swings can liquidate careless margin positions.

- Watch proof-of-work difficulty adjustments; rising hash rates often precede price rallies.

- Diversify across cold storage (crypto wallets) and exchanges to mitigate counterparty risk.

Whether you’re a Satoshi Nakamoto-style maximalist or a crypto trading opportunist, aligning your strategy with Bitcoin’s store of value thesis and short-term technicals maximizes returns.

Bitcoin Tech Advances

The Bitcoin ecosystem has witnessed groundbreaking tech advances in recent years, solidifying its position as the leading cryptocurrency by market capitalization. One of the most significant upgrades is Taproot, implemented in late 2021, which enhanced Bitcoin's scripting capabilities while improving privacy and scalability. By bundling multiple signatures into a single cryptographic proof, Taproot optimizes blockchain efficiency—a leap forward for peer-to-peer transactions. Another game-changer is the Lightning Network, a decentralized layer-2 solution that enables near-instant micropayments with negligible fees. Companies like Binance and Coinbase have integrated Lightning, making crypto trading faster and cheaper. Meanwhile, institutional adoption has surged, with BlackRock launching a Bitcoin ETF in early 2024, followed by MicroStrategy doubling down on its BTC holdings as digital gold.

On the mining front, innovations in proof-of-work algorithms have made Bitcoin mining more energy-efficient, addressing long-standing environmental concerns. Renewable energy projects now power over 50% of mining operations, according to 2025 data. The Bitcoin halving in April 2024 further tightened supply, reinforcing Bitcoin’s store of value proposition. Developers continue refining Bitcoin Core, with recent updates focusing on Schnorr signatures and cross-input signature aggregation. Even nation-states are joining the revolution: El Salvador expanded its Bitcoin-backed bonds program in 2025, leveraging the blockchain for economic growth.

For investors and users, these advances translate to tangible benefits. The rise of regulated exchange-traded funds (ETFs) has made Bitcoin more accessible, while non-custodial crypto wallets empower individuals with true ownership—a principle championed by Satoshi Nakamoto. Looking ahead, expect deeper integration of AI-driven analytics in crypto exchanges and further optimization of the Lightning Network for mainstream payments. The combination of institutional trust (thanks to players like BlackRock) and grassroots adoption (evident in El Salvador’s policies) ensures Bitcoin’s tech evolution remains unstoppable. Whether it’s through mining upgrades, scaling solutions, or financial products, Bitcoin is rewriting the rules of global finance—one block at a time.