Professional illustration about American

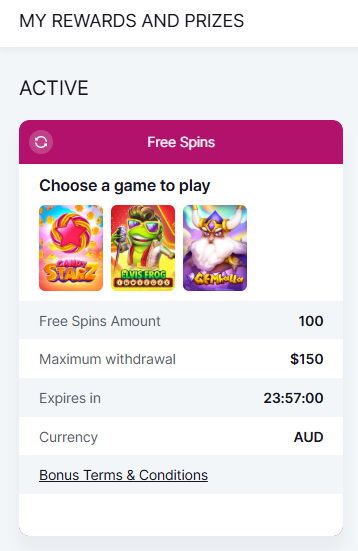

Gold Coin Basics

Gold Coin Basics: Understanding the Foundation of Precious Metal Investments

Gold coins have long been a cornerstone of wealth protection and gold investment, offering both tangible assets and historical value. Whether you're a seasoned investor or a newcomer to precious metals, understanding the basics of gold bullion coins is essential. These coins are typically categorized into two main types: bullion coins (valued primarily for their metal content) and numismatic coins (valued for rarity and collectibility). For most investors, bullion coins like the American Eagle, American Buffalo, or Canadian Gold Maple Leaf are the go-to choices due to their liquidity and direct ties to the spot price of gold.

One of the first factors to consider when evaluating gold coin prices is purity, measured in karats or fineness. For example, the American Gold Eagle contains 91.67% gold (22-karat), while the Canadian Gold Maple Leaf and Austrian Gold Philharmonic boast 99.99% purity (24-karat). Higher purity often means softer coins, so durability can vary. Weight is another critical aspect, with most gold bullion coins minted in 1 oz, ½ oz, ¼ oz, and 1/10 oz sizes. Smaller denominations, like the Chinese Gold Panda or South African Gold Krugerrand, provide flexibility for investors with varying budgets.

Premiums over the live gold prices are unavoidable but vary by coin and dealer. For instance, the Gold Krugerrand coins from the South African Mint or the Perth Mint’s offerings may carry different premiums based on demand and minting costs. It’s wise to compare gold premiums across dealers to maximize value. Additionally, government-backed coins like the American Eagle or Gold Canadian Maple Leaf Coin often have higher recognition, making them easier to sell later.

Storage and authentication are equally important. Reputable dealers provide certificates of authenticity, especially for coins like the Gold Chinese Panda Coin, which changes designs annually. Storing coins in airtight capsules or safes protects them from environmental damage. Finally, staying updated on gold spot price trends ensures you buy or sell at optimal times. By mastering these gold coin basics, you’ll be better equipped to navigate the precious metal coins market with confidence.

Pro Tip: Diversify your holdings with a mix of coins like the Austrian Gold Philharmonic (popular in Europe) and the American Buffalo (a favorite in the U.S.) to hedge against regional market fluctuations. Always verify purity and weight markings—counterfeits do exist, particularly for high-demand coins like the Gold Krugerrand.

Professional illustration about American

Investing in Gold

Investing in gold coins is one of the most reliable ways to diversify your portfolio and protect your wealth against economic uncertainty. In 2025, gold bullion coins remain a top choice for both new and experienced investors due to their liquidity, recognized value, and intrinsic worth. Unlike numismatic coins, which derive value from rarity and condition, bullion coins are prized for their gold purity and weight, making them a straightforward investment tied to the spot price of gold.

Some of the most sought-after gold bullion coins include the American Eagle, American Buffalo, and American Gold Eagle, all minted with .9167 purity (22-karat gold). The Canadian Gold Maple Leaf and Austrian Gold Philharmonic stand out for their .9999 fine gold content, appealing to investors who prioritize higher gold coin purity. Meanwhile, the South African Gold Krugerrand (also .9167 pure) remains a historic favorite, while the Chinese Gold Panda offers unique annual designs, blending collectibility with investment value.

When evaluating gold coin prices, consider both the live gold prices (which fluctuate daily) and the gold premiums charged by dealers. Premiums vary based on mint, rarity, and demand—for example, Perth Mint and South African Mint coins may carry different premiums due to production costs or regional demand. To maximize value, monitor the gold spot price and buy during market dips. Storage is another key factor; while some investors prefer home safes, others opt for secure vaults or IRA-approved depositories for precious metal coins.

For long-term wealth protection, experts recommend allocating 5-10% of your portfolio to precious metals, with gold coins serving as a hedge against inflation and currency devaluation. Smaller denominations (like 1/10 oz or 1/4 oz coins) offer flexibility, while 1 oz coins like the Gold Krugerrand coins or Gold Canadian Maple Leaf Coin provide cost efficiency per ounce. Always verify authenticity by purchasing from reputable dealers and checking for proper hallmarks, weights, and finishes.

Tax implications are another consideration. In the U.S., gold bullion coins are classified as collectibles, meaning long-term gains may be taxed at a higher rate than stocks. However, their tangible nature and global recognition make them a resilient asset during geopolitical crises. Whether you’re drawn to the iconic American Eagle or the artistry of the Gold Chinese Panda Coin, investing in physical gold offers stability in an unpredictable financial landscape.

Professional illustration about Perth

Rare Coin Values

Understanding Rare Coin Values in 2025: What Makes Certain Gold Coins More Valuable?

When it comes to gold investment, not all coins are created equal. While gold bullion coins like the American Eagle or Canadian Gold Maple Leaf are prized for their purity and liquidity, rare coin values often hinge on factors beyond just the spot price of gold. Collectors and investors pay premiums for coins with historical significance, limited mintage, or unique design variations. For example, a 2025 American Gold Eagle with a low mintage or special finish could command a higher price than its bullion counterpart, even if both contain the same amount of gold.

Key Factors Influencing Rare Coin Values

- Mintage Numbers: Coins with limited production runs, like certain years of the Chinese Gold Panda or Austrian Gold Philharmonic, tend to appreciate over time. The South African Gold Krugerrand, for instance, saw a surge in value for its 1967 debut edition due to its historical importance.

- Condition and Grading: A Gold Canadian Maple Leaf Coin graded MS-70 (perfect mint state) can sell for significantly more than an ungraded version. Professional grading services like PCGS or NGC add credibility and boost resale value.

- Design Variations: The Perth Mint often releases special editions with unique privy marks or holograms, which attract collectors. Similarly, the American Buffalo series includes proof versions with mirrored finishes that carry higher premiums.

- Market Demand: Trends in precious metal coins fluctuate. In 2025, geopolitical uncertainty has increased demand for wealth protection assets, driving up prices for rare coins like the Gold Krugerrand coins or vintage American Gold Eagle editions.

Spot Price vs. Premiums: Why Rare Coins Outperform Bullion

While the live gold prices dictate the base value of gold bullion, rare coins often trade at higher gold premiums due to their numismatic appeal. For instance, a 1-oz Gold Chinese Panda Coin from a rare year might sell for 20–50% above its melt value, whereas a standard bullion coin trades closer to the gold spot price. This makes rare coins a dual-purpose asset: they offer exposure to gold purity and weight while potentially appreciating independently of market swings.

Practical Tips for Evaluating Rare Coins

- Research Mintage Data: Check official mint reports for low-production years (e.g., the South African Mint’s 2025 releases).

- Focus on Liquidity: Coins like the American Eagle or Gold Krugerrand are easier to sell than obscure issues.

- Verify Authenticity: Use reputable dealers and grading services to avoid counterfeits, especially for high-value coins like the Austrian Gold Philharmonic.

- Diversify: Balance your portfolio with both numismatic coins (for appreciation) and bullion coins (for stability).

The Bottom Line

In 2025, rare gold coins remain a compelling blend of tangible asset and collectible. Whether you’re eyeing a Canadian Gold Maple Leaf with a unique finish or a vintage American Buffalo, understanding the nuances of rare coin values can help you make smarter precious metals investments. Keep an eye on gold coin prices, but don’t overlook the stories and scarcity that drive long-term value.

Professional illustration about Bullion

Bullion vs Numismatic

When it comes to investing in gold coins, understanding the difference between bullion and numismatic coins is crucial for making informed decisions. Gold bullion coins, like the American Eagle, American Buffalo, or Canadian Gold Maple Leaf, are primarily valued for their metal content and purity. These coins are minted by government-backed entities such as the Perth Mint, South African Mint, or the U.S. Mint, ensuring their weight and gold purity (typically .9999 fine gold) are standardized. Their prices closely track the spot price of gold, with a small premium added for production and distribution. For investors focused on wealth protection or hedging against inflation, bullion coins are a straightforward choice due to their liquidity and transparency in pricing.

On the other hand, numismatic coins derive value from rarity, historical significance, or collector demand rather than just their gold content. For example, a vintage South African Gold Krugerrand or a limited-edition Chinese Gold Panda might command prices far above the live gold prices due to their scarcity or unique designs. While these coins can offer substantial appreciation over time, they’re also subject to market trends and collector sentiment, making them riskier for those solely interested in gold investment. Numismatics often come with higher gold premiums and require expertise to authenticate and grade, which isn’t necessary for bullion coins like the Austrian Gold Philharmonic or the Gold Canadian Maple Leaf Coin.

Here’s a quick breakdown of key differences:

- Liquidity: Bullion coins are easier to buy and sell quickly, as their value is tied to the gold spot price. Numismatic coins may take longer to find the right buyer.

- Cost: Bullion coins have lower premiums, while numismatics can carry significant markups based on rarity.

- Purpose: Bullion is ideal for precious metals investors; numismatics appeal to collectors or those betting on long-term appreciation.

- Purity & Weights: Most gold bullion coins adhere to strict standards (e.g., 1 oz, .9999 fine), whereas numismatic coins vary widely.

For beginners, sticking with gold bullion coins is often the safer route. Coins like the American Gold Eagle or Gold Krugerrand coins are widely recognized and traded globally. However, if you’re passionate about history or rare precious metal coins, numismatics can be a rewarding niche—just be prepared for higher research and acquisition costs. Always check the latest gold coin prices and consult reputable dealers to avoid overpaying, especially in a dynamic market like 2025’s.

Professional illustration about Krugerrand

Gold Coin Grading

Gold Coin Grading: Understanding Quality and Value in 2025

Grading gold coins is essential for both investors and collectors, as it directly impacts their market value and authenticity. Whether you own American Eagle, American Buffalo, or Perth Mint coins, understanding the grading system ensures you make informed decisions. The most widely accepted standard is the Sheldon Scale, which ranges from 1 (poor condition) to 70 (perfect mint state). Coins graded 60 or higher are considered uncirculated, meaning they’ve never been used in commerce, while those below 60 show varying degrees of wear.

For gold bullion coins like the South African Gold Krugerrand or Canadian Gold Maple Leaf, grading focuses on gold purity (typically .9999 fine gold) and physical imperfections. Even minor scratches or toning can affect premiums, especially for numismatic coins like the Chinese Gold Panda or Austrian Gold Philharmonic, where rarity and condition drive prices. Third-party grading services like PCGS (Professional Coin Grading Service) and NGC (Numismatic Guaranty Company) provide certification, adding credibility and liquidity to your holdings.

When evaluating gold coin prices, consider these key factors:

- Strike Quality: Sharpness of design details (e.g., the buffalo’s mane on an American Buffalo coin).

- Surface Preservation: Lack of scratches, dents, or discoloration.

- Luster: Original mint brilliance, which diminishes with handling.

- Eye Appeal: Subjective attractiveness, critical for high-end collectibles.

For example, a Gold Krugerrand coin graded MS-70 can command a 20–30% premium over the spot price of gold, while the same coin in AU-50 (about uncirculated) might trade closer to melt value. Investors prioritizing wealth protection often opt for lower-grade bullion to minimize premiums, whereas collectors target higher grades for long-term appreciation.

In 2025, advancements in grading technology, such as AI-assisted imaging, have made assessments more precise. However, counterfeit risks persist, particularly for sought-after coins like the American Gold Eagle. Always verify certifications and purchase from reputable dealers to ensure authenticity. Whether you’re stacking precious metal coins for gold investment or building a numismatic portfolio, mastering grading nuances maximizes returns and minimizes risks.

Pro Tip: Track live gold prices and gold premiums regularly—graded coins often follow market trends but can deviate based on collector demand. For instance, limited-edition Gold Chinese Panda Coins with high grades have outperformed generic bullion in recent auctions, proving that condition matters as much as gold coin weights and purity.

Professional illustration about Krugerrand

Top 2025 Gold Coins

When it comes to gold investment, the top 2025 gold coins offer a perfect blend of wealth protection, liquidity, and collectible value. Leading the pack are the American Eagle and American Buffalo coins, both minted by the U.S. Mint with a gold purity of 22-karat (91.67%) and 24-karat (99.99%), respectively. The American Gold Eagle remains a favorite among investors due to its iconic design, legal tender status, and widespread recognition. Meanwhile, the American Buffalo appeals to those seeking pure gold bullion coins with no added alloys, making it a premium choice for precious metal enthusiasts.

For collectors and investors looking beyond U.S. mints, the Canadian Gold Maple Leaf stands out with its 99.99% purity and advanced security features, including micro-engraved radial lines to deter counterfeiting. Another top contender is the Chinese Gold Panda, known for its annually changing panda design and gold coin purity of 99.9%. The Austrian Gold Philharmonic, backed by Austria’s prestigious mint, is another excellent option, especially for those who appreciate classical music-themed designs and gold bullion coins with high liquidity in European markets.

The South African Mint continues to dominate with its legendary Gold Krugerrand, the world’s first modern gold bullion coin. The South African Gold Krugerrand contains 22-karat gold (91.67% purity) and is alloyed with copper for durability, making it a robust choice for long-term holdings. Over in Australia, the Perth Mint produces some of the finest precious metal coins, including the Kangaroo and Lunar Series, which combine investment-grade gold with artistic craftsmanship.

When evaluating gold coin prices, it’s essential to consider factors like gold spot price, gold premiums, and gold coin weights. For instance, live gold prices directly impact the base value of these coins, while premiums vary based on rarity, mint, and demand. A 1-oz Gold Canadian Maple Leaf Coin might carry a lower premium than a limited-edition Gold Chinese Panda Coin, making the former more cost-effective for pure gold investment.

For those prioritizing numismatic coins, certain editions of the American Eagle or Chinese Panda with unique finishes (like proof or reverse-proof) can appreciate beyond gold bullion value. However, if the goal is purely wealth protection, sticking to widely traded bullion coins like the Krugerrand or Maple Leaf ensures easier liquidation. Regardless of preference, diversifying across mints and designs can optimize both precious metals portfolios and collector appeal in 2025.

Professional illustration about Krugerrand

Coin Storage Tips

Proper storage is crucial for protecting your gold coins, whether you own American Eagle, American Buffalo, or international favorites like the Canadian Gold Maple Leaf or Chinese Gold Panda. The right storage solution preserves both the physical condition and long-term value of your precious metal coins, especially if you're holding them for wealth protection or future resale. Here’s a deep dive into best practices for safeguarding your gold bullion coins:

1. Climate-Controlled Environments Matter

Gold may not tarnish like silver, but extreme humidity or temperature fluctuations can damage coin surfaces or packaging. Store your Austrian Gold Philharmonic or South African Gold Krugerrand in a cool, dry place (ideally below 70°F with 40-50% humidity). Avoid basements (prone to moisture) and attics (temperature swings). For high-value collections, consider a fireproof safe with built-in dehumidifiers or silica gel packs to absorb excess moisture.

2. Choose the Right Containers

- Individual Capsules: Hard plastic capsules with airtight seals are ideal for numismatic coins like graded American Gold Eagles or Perth Mint issues. They prevent scratches and oxidation.

- Tubes: Original mint tubes (e.g., for Gold Krugerrand coins or Gold Canadian Maple Leaf coins) protect against dings and allow bulk storage.

- Felt-Lined Boxes: For display purposes, opt for acid-free, archival-quality boxes to avoid chemical reactions over time.

Never use PVC-based flips or cheap plastic bags—they can release gases that cloud coin surfaces.

3. Security vs. Accessibility Trade-Offs

Balance convenience with safety:

- Home Safes: Bolt-down models with UL ratings (e.g., UL 15/30) deter theft for smaller holdings of gold bullion.

- Bank Safe Deposit Boxes: Best for rare numismatic coins or large quantities, but inaccessible outside banking hours.

- Decoy Measures: Keep common-date gold coin prices accessible (like bullion-grade Chinese Gold Panda coins) while hiding key rarities elsewhere.

4. Insurance Documentation

Photograph each coin (front/back) alongside a dated newspaper to prove ownership. Note serial numbers for graded coins and track the spot price of gold to ensure coverage matches current live gold prices. Specialty insurers often offer better rates than homeowners’ policies for precious metals.

5. Handling Protocols

Even fingerprints can affect resale value. Handle gold coin purity items by the edges wearing cotton gloves. For frequently traded coins like the South African Mint’s offerings, minimize direct contact to preserve luster. Store coins upright to prevent stacking marks, especially important for softer 24-karat options like the American Buffalo.

6. Diversify Storage for Large Portfolios

If you own multiple Gold Maple Leafs or Gold Philharmonics, split them between locations (e.g., home safe + bank vault) to mitigate total loss risks. This aligns with broader gold investment strategies that emphasize diversification.

Pro Tip: Periodically inspect stored coins for toning or capsule fogging—early detection prevents irreversible damage. For collectors tracking gold premiums, pristine condition is critical to maximizing returns.

By tailoring storage to your specific mix of bullion coins and rarities, you’ll ensure their condition—and your peace of mind—stays golden for years to come.

Professional illustration about Chinese

Spot Price Trends

Spot Price Trends for Gold Coins in 2025

Tracking the spot price of gold is crucial for anyone investing in gold bullion coins, whether you're eyeing the American Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand. In 2025, gold prices have shown notable volatility, influenced by macroeconomic factors like inflation, geopolitical tensions, and shifts in central bank policies. The live gold prices you see today reflect real-time market demand, but when buying physical coins like the American Buffalo or Chinese Gold Panda, you'll pay a premium above the spot price due to minting costs, dealer margins, and collector demand.

For example, gold coin premiums in 2025 vary significantly by mint and design. The Perth Mint and Austrian Gold Philharmonic often carry lower premiums (3-5%) compared to rarer numismatic coins, which can command 10-20% above spot. Meanwhile, gold bullion coins like the Gold Krugerrand or American Gold Eagle typically fall in the 5-8% range, making them a balanced choice for investors prioritizing liquidity and wealth protection.

Here’s what’s driving spot price trends this year:

- Inflation Hedge Demand: With inflation lingering above pre-pandemic levels, investors are flocking to precious metals as a store of value, pushing gold prices upward.

- Central Bank Activity: The Fed’s interest rate decisions in 2025 have created short-term dips, but long-term demand remains strong as banks like China and India continue stockpiling gold.

- Geopolitical Uncertainty: Conflicts and trade wars have amplified gold’s safe-haven appeal, causing sporadic price spikes.

When evaluating gold coin prices, always cross-reference the spot price of gold with the coin’s gold purity and weight. For instance, the Gold Canadian Maple Leaf Coin is 99.99% pure, while the American Gold Eagle is 91.67% pure (22-karat) but contains a full ounce of gold due to its alloy mix. This difference affects how closely their prices track the spot market.

Pro tip: Use real-time gold spot price tools to time your purchases. In 2025, prices often dip during U.S. trading hours when liquidity is highest, making it an ideal window for buying gold bullion coins like the South African Mint’s offerings or the Chinese Gold Panda Coin.

Lastly, remember that precious metal coins aren’t just about the metal content—collectibility plays a role too. Limited-edition releases from the Perth Mint or vintage Gold Krugerrand coins can defy spot price trends entirely, appreciating based on rarity rather than raw material value. For pure investors, sticking to widely recognized bullion coins ensures you’re riding the gold investment wave without overpaying for niche appeal.

Professional illustration about Philharmonic

Ancient Gold Coins

Ancient gold coins hold a unique allure for both collectors and investors, blending historical significance with tangible wealth protection. Unlike modern bullion coins like the American Eagle or Canadian Gold Maple Leaf, ancient coins often carry numismatic value beyond their gold purity and gold spot price. These artifacts, minted centuries ago by civilizations such as the Romans, Greeks, and Byzantines, offer a window into the past while serving as a hedge against economic uncertainty.

For investors, ancient gold coins present a fascinating alternative to contemporary options like the South African Gold Krugerrand or Austrian Gold Philharmonic. While modern coins are prized for their standardized gold coin weights and high gold purity (typically .9999 fine), ancient coins vary widely in composition and craftsmanship. For example, the Roman aureus or the Greek stater often contained less pure gold but are highly sought after for their historical context. Collectors should note that gold coin prices for ancient pieces are influenced by factors like rarity, condition, and provenance, not just the live gold prices.

When evaluating ancient gold bullion coins, it’s crucial to distinguish between numismatic coins (valued for their historical and artistic merit) and precious metal coins (valued primarily for their gold content). A coin from the reign of Emperor Augustus might command a premium far above its melt value, whereas a Byzantine solidus could appeal to those focused on gold investment as a store of value. Experts recommend working with reputable dealers who specialize in ancient coins, as authenticity and grading are paramount.

Here’s a quick comparison of ancient versus modern gold coins:

- Ancient coins: Irregular weights, lower purity (often 80-90% gold), and historical significance. Examples include the Persian daric or the Celtic stater.

- Modern bullion coins: Uniform weights (e.g., 1 oz), high purity (.999 or higher), and liquidity. Think American Buffalo or Chinese Gold Panda.

For those diversifying their precious metals portfolio, ancient coins add a layer of depth. However, they require more research than buying contemporary gold bullion. Always check the gold premiums associated with ancient pieces, as these can vary dramatically based on demand among collectors. Whether you’re drawn to the artistry of a Phoenician shekel or the reliability of a Perth Mint product, understanding the nuances of gold coin purity and market trends is key to making informed decisions.

Pro tip: If you’re new to ancient gold coins, start with well-documented issues from reputable auctions or dealers. Coins with clear attribution (e.g., from the reign of Alexander the Great) tend to hold their value better than anonymous or heavily worn pieces. And remember, while the spot price of gold influences all precious metal coins, the story behind an ancient coin can be just as valuable as the metal itself.

Coin Authentication

Coin Authentication: How to Verify the Legitimacy of Gold Bullion Coins

When investing in gold coins like the American Eagle, American Buffalo, or Canadian Gold Maple Leaf, authentication is critical to ensure you’re getting genuine precious metals—not counterfeits. With gold coin prices tied to the spot price of gold, paying for a fake could mean significant financial loss. Here’s how to authenticate popular bullion coins like the South African Gold Krugerrand, Chinese Gold Panda, and Austrian Gold Philharmonic.

1. Check Weight and Dimensions

Every legitimate gold bullion coin has precise specifications. For example:

- The American Gold Eagle (1 oz) weighs 33.93 grams with a diameter of 32.7mm.

- The Gold Krugerrand coins (1 oz) weigh 33.93 grams, matching the American Eagle due to their 22-karat gold content.

- The Gold Canadian Maple Leaf (1 oz) is 24-karat, weighing exactly 31.103 grams (1 troy ounce).

Use a calibrated scale and calipers to verify these measurements. Even minor deviations suggest a counterfeit.

2. Verify Purity and Hallmarks

Reputable mints like the Perth Mint or South African Mint stamp their coins with purity marks. Look for:

- .9999 (or 24K) on the Canadian Gold Maple Leaf and Chinese Gold Panda Coin.

- .9167 (22K) on the American Gold Eagle and Gold Krugerrand, indicating alloyed gold for durability.

- Mint-specific logos, such as the Perth Mint’s kangaroo or the Austrian Gold Philharmonic’s harp.

Counterfeits often have blurred or incorrect markings. A magnifying glass or jeweler’s loupe helps inspect fine details.

3. Magnet and Ping Tests

4. Edge Lettering and Reeding

Many numismatic coins and bullion coins have unique edge designs. For instance:

- The American Buffalo has smooth edges.

- The Austrian Gold Philharmonic features finely milled reeding.

- The Chinese Gold Panda often includes security features like micro-engraving.

Inspect edges for inconsistencies, which are red flags for counterfeits.

5. Professional Authentication

For high-value coins like the American Gold Eagle or rare numismatic coins, consider third-party grading services. These experts verify authenticity, gold purity, and condition, often encapsulating coins in tamper-proof holders.

6. Spot Price and Premiums

If a deal seems too good to be true, it probably is. Compare live gold prices to the seller’s asking price. Legitimate dealers charge a small gold premium over the spot price of gold for minting and distribution costs. Extremely low prices often indicate fakes.

7. Trusted Sources

Stick to reputable dealers or government mints when buying gold coins. The U.S. Mint, Perth Mint, and Royal Canadian Mint are reliable for American Eagle, Australian Kangaroo, and Canadian Gold Maple Leaf coins, respectively. Avoid private sellers without verifiable credentials.

By combining these methods, you can confidently authenticate gold bullion coins and protect your wealth protection strategy. Whether you’re holding South African Gold Krugerrand or Chinese Gold Panda coins, vigilance ensures your investment’s integrity.

Gold IRA Options

Gold IRA Options: Diversifying with Gold Coins in 2025

If you're considering a Gold IRA as part of your retirement strategy, incorporating gold coins can be a smart move. Unlike paper assets, physical gold offers wealth protection against inflation and market volatility. The IRS allows specific bullion coins in a Gold IRA, provided they meet minimum gold purity standards (typically .995 fine or higher). Among the most popular options are the American Gold Eagle and American Buffalo, both minted by the U.S. government and widely recognized for their gold coin purity (22-karat for Eagles, 24-karat for Buffalos). These coins carry a slight premium over the spot price of gold but are highly liquid, making them ideal for long-term holdings.

For investors seeking precious metals with global appeal, the Canadian Gold Maple Leaf (24-karat) and Austrian Gold Philharmonic (also 24-karat) are excellent choices. The Maple Leaf, produced by the Royal Canadian Mint, is renowned for its intricate design and security features, while the Philharmonic celebrates Vienna’s musical heritage and trades close to the live gold prices. Another standout is the South African Gold Krugerrand, the world’s first modern gold bullion coin. Though slightly lower in purity (22-karat), Krugerrands are historically significant and often priced competitively relative to the gold spot price.

If you prefer coins with dynamic designs, the Chinese Gold Panda and Perth Mint’s offerings are worth exploring. The Panda’s design changes annually (except for the 2025 edition, which retains the 2024 design), adding a numismatic coins appeal. However, be mindful of higher gold premiums for these due to collector demand. For investors focused solely on gold bullion coins, sticking to government-minted options like the Gold Canadian Maple Leaf coin or American Gold Eagle ensures compliance with IRA rules and maximizes liquidity.

When selecting coins for your Gold IRA, prioritize precious metal coins with high liquidity and recognizable branding. Avoid rare or graded coins unless you’re comfortable with higher fees and potential illiquidity. Always verify the gold coin weights and purity to ensure IRS eligibility, and work with a reputable custodian to handle storage and reporting. In 2025, with gold investment demand rising, diversifying your IRA with these trusted coins can provide stability amid economic uncertainty.

Pro Tip: Monitor the gold coin prices regularly, as premiums fluctuate based on mint availability and market demand. Coins like the Gold Krugerrand coins or American Buffalo may offer better value during seasonal dips in the precious metals market. Lastly, remember that while gold bullion is a hedge, it shouldn’t dominate your retirement portfolio—balance is key.

Minting Process

The minting process of gold coins is a fascinating blend of precision engineering, artistic craftsmanship, and stringent quality control. Whether you're investing in gold bullion coins like the American Eagle or the Canadian Gold Maple Leaf, or collecting numismatic coins like the Chinese Gold Panda, understanding how these coins are made can deepen your appreciation for their value. Modern mints, such as the Perth Mint, South African Mint, and the U.S. Mint, follow a rigorous multi-step process to ensure each coin meets exacting standards for gold purity, weight, and design integrity.

First, raw gold is refined to achieve the desired gold purity, typically .9999 fine (24-karat) for coins like the Austrian Gold Philharmonic or .9167 (22-karat) for the American Gold Eagle, which includes small amounts of silver and copper for durability. The refined gold is then cast into blanks, also called planchets, which are precisely weighed to match the coin's specifications—for example, 1 oz for the Gold Krugerrand or 1/10 oz for smaller denominations. Any planchet that doesn’t meet the weight tolerance is melted down and recycled, ensuring consistency across every batch.

Next, the blanks undergo an annealing process to soften the metal, making it easier to strike. They’re then washed and polished to remove impurities before being fed into high-pressure coin presses. Here, custom-designed dies imprint the intricate designs onto the blanks, transforming them into finished coins. The American Buffalo, for instance, features a highly detailed relief of a Native American chief on the obverse and a buffalo on the reverse, requiring multiple strikes to achieve sharp definition. Similarly, the Gold Chinese Panda Coin is renowned for its annually changing panda design, a feat of artistic and technical collaboration.

Quality control is paramount. Each coin is inspected for imperfections, such as misalignments or surface blemishes, and only those passing strict standards are packaged and released. Premiums on gold coin prices often reflect the mint’s reputation for quality—coins from mints like the Perth Mint or the South African Gold Krugerrand series command higher gold premiums due to their consistent craftsmanship and global recognition.

For investors, the minting process directly impacts a coin's liquidity and wealth protection value. Bullion coins like the Gold Canadian Maple Leaf are valued primarily by their gold spot price and purity, while numismatic coins may carry additional value based on rarity and condition. Whether you're tracking live gold prices or building a diversified portfolio, knowing how your coins are made ensures you’re making informed decisions in the precious metals market.

Finally, advancements in minting technology continue to elevate quality. Laser engraving and anti-counterfeiting features, such as micro-engraved security marks on the Canadian Gold Maple Leaf, are becoming standard, adding layers of protection for investors. As gold investment grows in popularity, the meticulous minting process remains a cornerstone of trust and value in the world of precious metal coins.

Counterfeit Detection

Counterfeit Detection: How to Spot Fake Gold Coins Like a Pro

With gold prices soaring in 2025, counterfeiters are getting craftier, targeting high-demand coins like the American Gold Eagle, Gold Krugerrand, and Canadian Gold Maple Leaf. Here’s how to protect your investment:

1. Check Weight and Dimensions

Authentic gold bullion coins have precise specs. For example, a 1-oz Gold Krugerrand should weigh 33.93g (1.09 troy oz) with a diameter of 32.6mm. Use a calibrated scale and calipers—even a 0.1mm deviation can signal a fake. The Austrian Gold Philharmonic, known for its 999.9 purity, should feel denser than lower-purity counterfeits.

2. Magnet Test (But Don’t Rely on It Alone)

Gold is non-magnetic. Hold a rare-earth magnet (like neodymium) near your Chinese Gold Panda or Perth Mint coin—if it sticks, it’s plated tungsten (a common scam). Note: Some fakes use non-magnetic alloys, so pair this with other tests.

3. Ping Test for Sound Authenticity

Genuine gold coins ring with a high-pitched, long-lasting resonance. Try this: Balance your American Buffalo on a fingertip and tap it with another coin. Fakes produce a dull "thud" due to mixed metals. Pro tip: Compare against a verified coin from the South African Mint or Royal Canadian Mint.

4. Edge Inspection

Look for reeding (ridges) patterns. The Gold Canadian Maple Leaf has 100+ perfectly spaced ridges, while fakes often show uneven counts or blurry edges. Also, check for seams—a telltale sign of gold-plated counterfeit coins.

5. Sigma Metalytics or XRF Testing

For high-value purchases (like a Gold American Eagle), invest in a Sigma Precious Metals Verifier. It measures conductivity to confirm purity without damage. XRF guns, used by dealers, analyze metal composition but cost $15K+.

Red Flags to Watch For

- Too-Good-to-Be-True Premiums: If a Gold Chinese Panda is priced below spot gold prices, it’s likely fake.

- Off-Color Toning: Real gold coins don’t tarnish. A Gold Krugerrand coin with reddish hues may be copper-coated.

- Mint Mark Errors: Compare logos (e.g., the Perth Mint’s kangaroo) to official images.

Why It Matters

Counterfeit gold bullion coins undermine wealth protection strategies. Always buy from reputable dealers (like APMEX or JM Bullion) and insist on assay certificates for numismatic coins. Stay updated—scammers now mimic advanced features like the Austrian Gold Philharmonic’s micro-engraved security mark.

Final Pro Tip

Document your coins’ serial numbers (e.g., South African Gold Krugerrand’s unique batch codes) and store them securely. If you suspect a fake, consult a professional grader like PCGS or NGC—don’t risk your precious metals portfolio on guesswork.

Collector Strategies

Collector Strategies for Gold Coins in 2025

Building a gold coin collection in 2025 requires a mix of market awareness, strategic buying, and an eye for long-term value. Whether you're focusing on Gold Bullion Coins like the American Eagle or American Buffalo, or exploring international options like the Canadian Gold Maple Leaf or Chinese Gold Panda, here’s how to refine your approach for maximum returns.

Focus on Purity and Weight

One of the first things savvy collectors consider is gold coin purity and gold coin weights. Coins like the Austrian Gold Philharmonic (24-karat, .9999 fine) or the South African Gold Krugerrand (22-karat, .9167 fine) offer different advantages. Higher purity (e.g., .9999) often carries lower premiums, while 22-karat coins like the Gold Krugerrand are more durable for handling. Always cross-reference the spot price of gold to avoid overpaying—premiums should align with rarity and demand.

Diversify by Mint and Series

Spreading your collection across mints—such as the Perth Mint, South African Mint, or the U.S. Mint—reduces risk and taps into niche markets. For example:

- The American Gold Eagle remains a staple for U.S. investors due to its liquidity and recognition.

- The Gold Chinese Panda Coin changes designs annually, making older years highly sought after.

- Limited editions, like the Canadian Gold Maple Leaf with special finishes (e.g., privy marks), can appreciate faster than standard bullion.

Timing Your Purchases

Tracking live gold prices is critical. When the gold spot price dips, prioritize coins with lower premiums (e.g., generic gold bullion over numismatic pieces). Conversely, during stable or rising markets, shift focus to rare or graded coins (e.g., MS-70 American Buffalo coins) that outperform raw bullion. Subscription services for gold coin prices alerts can help spot trends.

Condition and Certification

For numismatic coins, condition is everything. Coins graded by PCGS or NGC (e.g., PR-70 American Eagle proofs) command higher premiums. Even for bullion, uncirculated coins in original mint packaging (e.g., Perth Mint assay cards) preserve value. Avoid cleaned or damaged pieces—their gold premiums rarely recover.

Theme-Based Collecting

Specializing in a theme (e.g., wildlife series like the Chinese Panda or music-themed Austrian Philharmonic) can make your collection more cohesive and desirable. For instance, completing a date run of Gold Krugerrand coins from the 1970s to 2025 creates a historical narrative that appeals to niche buyers.

Storage and Insurance

Even the best precious metal coins lose value if stored improperly. Use airtight capsules for raw coins and bank vaults or insured home safes for larger holdings. Document each piece’s details (weight, purity, purchase price) to streamline resale and wealth protection.

By combining these strategies—balancing bullion for liquidity and numismatics for growth—you’ll build a collection that thrives regardless of market fluctuations. Keep an eye on emerging trends, like new releases from the South African Mint or shifts in gold investment demand, to stay ahead in 2025.

Selling Gold Coins

Selling gold coins can be a lucrative venture if you understand the market dynamics and know how to maximize returns. Whether you're dealing with Gold Bullion Coins like the American Eagle, American Buffalo, or Canadian Gold Maple Leaf, or exploring international options such as the South African Gold Krugerrand or Chinese Gold Panda, timing and strategy are everything. In 2025, the demand for precious metal coins remains strong, driven by investors seeking wealth protection amid economic uncertainty.

First, assess whether your coins are bullion coins (valued primarily for their gold content) or numismatic coins (collector’s items with additional value). Bullion coins like the American Gold Eagle or Perth Mint products are tied closely to the spot price of gold, meaning their value fluctuates with live gold prices. Numismatic coins, such as rare editions of the Austrian Gold Philharmonic, may command higher gold premiums due to rarity or historical significance.

When selling, always check the gold coin prices in real-time. Platforms like reputable dealers or online auctions can offer competitive rates, but be wary of hidden fees. For example, the Gold Krugerrand coins from the South African Mint often trade at a slight premium over the gold spot price, while the Gold Chinese Panda Coin may vary based on annual design changes.

Here are some actionable tips for selling:

- Know your coin’s specs: Verify gold coin purity (e.g., 24-karat for the Canadian Gold Maple Leaf vs. 22-karat for the American Eagle) and gold coin weights, as these directly impact value.

- Compare buyers: Local coin shops may offer convenience, but online buyers often provide better rates for precious metals.

- Timing matters: Monitor gold bullion trends—selling during a price surge can significantly boost profits.

- Documentation is key: Keep certificates of authenticity, especially for coins like the Chinese Gold Panda, where provenance affects resale value.

For bulk sales, consider working with a trusted dealer specializing in Gold Bullion Coins. They can offer wholesale rates, particularly for high-demand items like the American Buffalo or South African Mint products. If you’re holding older or rare editions, consulting a numismatic expert could uncover hidden value beyond the gold spot price.

Finally, transparency is crucial. Disclose any wear or damage, as even minor scratches can reduce offers for coins like the Austrian Gold Philharmonic. By staying informed and strategic, you can turn your gold investment into a profitable transaction in 2025’s competitive market.