Professional illustration about Venmo

PayPal in 2025 Overview

As we step into 2025, PayPal continues to dominate the digital wallet and payment processing landscape, offering a seamless blend of innovation and reliability. With over 400 million active accounts globally, PayPal has solidified its position as a leader in financial technology, integrating services like Venmo for peer-to-peer transfers and expanding its buy now pay later (BNPL) options. The platform’s partnerships with major institutions like Synchrony Bank and The Bancorp Bank ensure robust backing for its financial products, including the PayPal Credit Card, PayPal Debit Card, and the popular PayPal Cashback Mastercard. These cards not only provide cash back rewards but also leverage Mastercard’s global network for wider acceptance.

One of PayPal’s standout features in 2025 is its enhanced payment security and fraud detection systems. Advanced identity verification protocols and AI-driven monitoring tools have significantly reduced unauthorized transactions, making it a trusted choice for both consumers and merchants. The company’s collaboration with Paxos Trust Company has also strengthened its cryptocurrency offerings, allowing users to buy, sell, and hold digital assets directly within their PayPal wallets. This move has attracted a new wave of tech-savvy users looking for integrated financial services.

For shoppers, PayPal’s instant checkout feature remains a game-changer, especially with its expansive merchant catalogs that include brands like Abercrombie & Fitch, Adorama, and Ashley Furniture. The platform’s rewards program incentivizes frequent use, offering points redeemable for travel, gift cards, or statement credits. Dmitry Shevelenko, PayPal’s Head of Consumer Products, recently highlighted the company’s focus on personalization, using machine learning to tailor money transfer and spending recommendations based on user behavior.

Behind the scenes, PayPal’s partnership with FDIC-insured banks ensures that user funds are protected, adding an extra layer of trust. Whether you’re sending money to family, splitting bills with friends via Venmo, or shopping online with payment systems designed for speed and security, PayPal in 2025 is more versatile than ever. The platform’s commitment to financial technology innovation ensures it stays ahead of competitors, continually adapting to meet the evolving needs of its global user base.

For businesses, PayPal’s merchant solutions have also seen upgrades, with streamlined onboarding and lower transaction fees for high-volume sellers. The integration of buy now pay later options at checkout has boosted conversion rates, particularly in industries like fashion and electronics. With its finger firmly on the pulse of financial service trends, PayPal isn’t just a payment processor—it’s a comprehensive ecosystem empowering both consumers and businesses in the digital age.

Professional illustration about Company

How PayPal Works Today

How PayPal Works Today

In 2025, PayPal remains one of the most widely used digital wallets and payment processing platforms globally, offering seamless transactions for both consumers and businesses. At its core, PayPal acts as a bridge between your bank account, credit/debit cards, and merchants, enabling instant checkout without repeatedly entering sensitive financial details. When you make a purchase, funds are either drawn from your linked bank account (via The Bancorp Bank or Synchrony Bank), your PayPal Credit Card, or your PayPal Debit Card—all while leveraging Mastercard's network for secure processing. For users who prefer flexibility, buy now pay later options are also integrated, allowing split payments over time.

One of PayPal’s standout features is its fraud detection and identity verification systems, which use advanced AI to flag suspicious activity. Every transaction is encrypted, and if you’re shopping at partner merchants like Abercrombie & Fitch, Adorama, or Ashley Furniture, you might even unlock exclusive rewards program benefits. For instance, the PayPal Cashback Mastercard offers up to 3% cash back on eligible purchases, making it a favorite among frequent shoppers.

Beyond traditional payments, PayPal has expanded into cryptocurrency services through partnerships like Paxos Trust Company, allowing users to buy, sell, and hold crypto directly in their accounts. Peer-to-peer transfers are equally streamlined—whether you’re splitting rent with roommates via Venmo (a PayPal-owned service) or sending money internationally. Notably, Dmitry Shevelenko, a key figure in PayPal’s product innovation, has emphasized the platform’s focus on integrating financial technology to simplify money transfer for everyday users.

For businesses, PayPal offers merchant catalogs and tools to accept payments online or in-store, with competitive fees and payment security measures. Funds are typically available immediately, and eligible balances are FDIC-insured up to $250,000 when held in PayPal’s partnered banks. Whether you’re a freelancer invoicing clients or a shopper chasing cash back deals, PayPal’s ecosystem in 2025 is designed to be as versatile as it is secure.

Here’s a quick breakdown of how PayPal functions in everyday scenarios:

- Online Shopping: Link your card or bank account, check out with PayPal’s one-click button, and let the system handle the rest.

- Peer Payments: Send money to friends using just an email or phone number, with options to request funds or split bills.

- Business Transactions: Merchants can generate invoices, accept multiple payment methods, and even offer financing through PayPal Credit.

- Cryptocurrency: Swap between Bitcoin, Ethereum, and other supported coins directly in your wallet.

With constant updates to its payment systems and a user-first approach, PayPal continues to evolve, ensuring speed, security, and convenience for millions worldwide.

Professional illustration about Mastercard

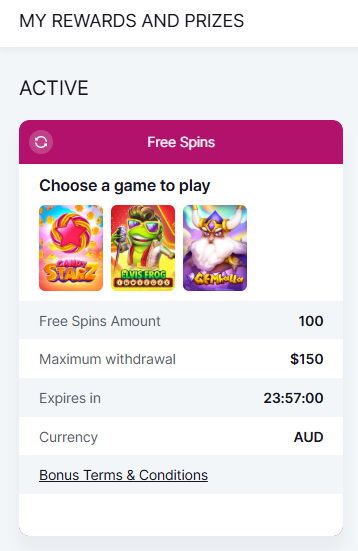

PayPal Fees Explained

Understanding PayPal Fees in 2025: What You Need to Know

PayPal remains one of the most popular digital wallets for online transactions, but its fee structure can be confusing. Whether you're using PayPal Credit Card, PayPal Debit Card, or sending money through Venmo (owned by PAYPAL INC), fees vary depending on the transaction type. Here’s a breakdown of the most common charges you’ll encounter in 2025:

Domestic Payments: Sending money to friends or family in the U.S. using your PayPal balance or linked bank account is free. However, if you use a credit or debit card (like Mastercard), PayPal charges a 2.9% fee plus $0.30 per transaction. For merchants, the standard rate is 3.49% + $0.49 for online sales, though high-volume sellers may negotiate lower rates.

International Transfers: Cross-border payments come with higher fees—4.99% for personal transfers, plus a fixed fee based on the currency. Businesses pay up to 4.99% + $0.49 for international sales. PayPal’s money transfer service also includes a currency conversion fee of 3.5%–4.5%, which can add up quickly.

Buy Now, Pay Later (BNPL): PayPal’s installment plans (like PayPal Credit) are interest-free if paid within the promotional period (usually 6–24 months). Miss the deadline, though, and you’ll face steep APRs—up to 29.99% in 2025. Always check the terms before opting for BNPL at retailers like Abercrombie & Fitch or Ashley Furniture.

Cryptocurrency Transactions: PayPal’s partnership with Paxos Trust Company allows users to buy, sell, or hold crypto, but fees apply. Buying Bitcoin or Ethereum incurs a spread-based fee (typically 1.5%–2.3%), while conversions to fiat during checkout add another 1.5%.

Withdrawals and Cash Back: Transferring funds to your bank via Synchrony Bank or The Bancorp Bank (which issue PayPal’s cards) is free for standard transfers (1–3 business days). Instant transfers cost 1.75% (max $25). The PayPal Cashback Mastercard offers 2%–3% rewards, but remember—cash back is only redeemable through PayPal and can’t be withdrawn directly to your bank.

Pro Tips to Minimize Fees

- Use your PayPal balance or linked bank account for personal transfers to avoid card fees.

- For merchants, explore PayPal’s merchant catalogs for discounted rates on high-volume sales.

- Opt for standard bank withdrawals instead of instant transfers unless urgently needed.

- Leverage identity verification and fraud detection tools to avoid disputes, which can trigger additional charges.

By understanding these fees, you can make smarter decisions—whether you’re shopping at Adorama, splitting bills with friends, or running an online store. Always review PayPal’s latest terms, as Dmitry Shevelenko (PayPal’s Head of Consumer Products) has hinted at potential updates to the fee structure later this year.

Professional illustration about PAYPAL

PayPal Security Features

PayPal Security Features: Keeping Your Money Safe in 2025

When it comes to payment security, PayPal remains a leader in the financial technology space, offering robust protections for users of its digital wallet, PayPal Credit Card, and PayPal Debit Card. One of the standout features is fraud detection, powered by advanced AI that monitors transactions in real-time. If anything looks suspicious—like an unusually large purchase or a login from an unfamiliar device—PayPal’s system flags it immediately. For example, if someone tries to use your PayPal Cashback Mastercard at Abercrombie & Fitch or Adorama without your authorization, you’ll get an instant alert to confirm or deny the transaction.

Another layer of security is identity verification, which ensures only you can access your account. PayPal uses multi-factor authentication (MFA), requiring not just a password but also a one-time code sent to your phone or email. This is especially crucial for high-value transactions, like buying furniture from Ashley Furniture or transferring money through Venmo. Additionally, PayPal partners with trusted institutions like Synchrony Bank, The Bancorp Bank, and Paxos Trust Company to safeguard funds. For instance, balances held in PayPal’s FDIC-insured accounts are protected up to $250,000 per depositor, giving users peace of mind.

For payment processing, PayPal encrypts all data with 128-bit SSL technology, the same standard used by banks. Whether you’re using instant checkout on merchant catalogs or sending a money transfer, your financial details are never shared directly with sellers. Instead, PayPal acts as a secure intermediary. Dmitry Shevelenko, a fintech expert, has praised this approach for reducing the risk of data breaches.

The platform also excels in cryptocurrency security. If you buy or sell crypto through PayPal, your holdings are stored in offline cold storage, making them nearly immune to hacking. Plus, the buy now pay later feature includes built-in safeguards, like spending limits and mandatory credit checks, to prevent overspending.

Rewards programs, like those tied to Mastercard-backed PayPal cards, add another layer of security. For example, the PayPal Cashback Mastercard not only offers cash back but also includes Zero Liability Protection, meaning you won’t be held responsible for unauthorized charges.

In short, PayPal’s security ecosystem is designed to protect every aspect of your financial life—from everyday purchases to large transfers—making it one of the safest payment systems available in 2025.

Professional illustration about PayPal

PayPal vs Competitors

When comparing PayPal to its competitors in 2025, it’s clear that the platform remains a dominant force in digital wallets and payment processing, but rivals like Venmo (owned by PayPal Inc) and newer fintech players are closing the gap. PayPal’s strength lies in its versatility—offering everything from PayPal Credit Card options to buy now pay later services—while maintaining robust payment security and fraud detection systems. For example, partnerships with Synchrony Bank and The Bancorp Bank ensure FDIC-insured options like the PayPal Debit Card, giving users peace of mind. Meanwhile, competitors like Venmo focus heavily on social payments and instant transfers, appealing to younger demographics.

One area where PayPal outshines competitors is its rewards program, particularly with the PayPal Cashback Mastercard, which offers 2-3% cash back on purchases. This is a standout feature compared to Venmo’s more limited rewards structure. Additionally, PayPal’s integration with major merchant catalogs—including retailers like Abercrombie & Fitch, Adorama, and Ashley Furniture—makes it a go-to for instant checkout. Competitors often lack this level of merchant adoption, though some, like Paxos Trust Company, are gaining traction by specializing in cryptocurrency transactions, a space PayPal has cautiously entered.

Payment systems like Mastercard’s own digital wallet solutions compete with PayPal by emphasizing broader acceptance and lower fees, but PayPal counters with its financial technology ecosystem. For instance, PayPal Credit provides flexible financing options, while Dmitry Shevelenko, a key figure in PayPal’s innovation team, has pushed advancements in identity verification to reduce fraud. Where PayPal falls short is in peer-to-peer money transfer speed; Venmo and Cash App often process transfers faster, though sometimes at higher fees.

For businesses, PayPal’s financial services are hard to beat, offering scalable payment processing tools with detailed analytics. Smaller competitors may undercut PayPal on transaction fees, but they lack the global reach and fraud detection infrastructure. Ultimately, the choice between PayPal and its competitors depends on user priorities: seamless instant checkout and rewards (PayPal), social-centric transfers (Venmo), or niche features like crypto support (Paxos). Each platform has carved out its niche, but PayPal’s breadth of services keeps it at the forefront.

Professional illustration about Furniture

PayPal Business Benefits

PayPal Business Benefits

For businesses in 2025, PayPal remains a powerhouse in payment processing, offering a suite of tools designed to streamline transactions, enhance security, and boost revenue. One of the standout advantages is its instant checkout feature, which reduces cart abandonment by allowing customers to pay with just a few clicks—no need to re-enter payment details. This seamless experience is backed by payment security measures like fraud detection and identity verification, ensuring both merchants and buyers are protected.

Another major perk is PayPal’s integration with Venmo, which lets businesses tap into a younger, mobile-savvy audience. Venmo’s social payment features can drive engagement, especially for brands targeting Gen Z and Millennials. For example, retailers like Abercrombie & Fitch and Adorama have seen increased conversions by enabling Venmo payments, as customers appreciate the familiarity and convenience of the platform.

PayPal also excels in financial technology with its buy now pay later (BNPL) options, allowing businesses to offer flexible payment plans without taking on additional risk. This feature is particularly effective for higher-ticket items—Ashley Furniture, for instance, has reported higher average order values since integrating PayPal’s BNPL. Additionally, PayPal’s partnership with Synchrony Bank and The Bancorp Bank ensures reliable financing solutions, including the PayPal Credit Card and PayPal Debit Card, which come with rewards programs like cash back incentives to encourage repeat purchases.

For merchants looking to expand globally, PayPal supports money transfer in multiple currencies and collaborates with Mastercard to provide the PayPal Cashback Mastercard, a popular choice among frequent shoppers. The platform’s merchant catalogs also simplify inventory management, making it easier to sync products across sales channels.

Under the leadership of executives like Dmitry Shevelenko, PayPal has continued innovating, including ventures into cryptocurrency through partnerships with Paxos Trust Company. This opens doors for businesses to accept crypto payments, appealing to tech-forward customers. Plus, with FDIC-insured balances via certain accounts, businesses can trust PayPal for secure financial services.

In short, PayPal’s ecosystem—from digital wallet solutions to advanced payment systems—provides businesses with the tools to grow, protect revenue, and meet modern consumer expectations. Whether you’re a small boutique or a large e-commerce brand, leveraging PayPal’s features can translate to higher sales, smoother operations, and happier customers.

Professional illustration about Shevelenko

PayPal Personal Use

PayPal Personal Use is all about making everyday financial transactions smoother, safer, and more rewarding. Whether you're splitting dinner bills with friends via Venmo (owned by PAYPAL INC), shopping online with the PayPal Cashback Mastercard, or using buy now pay later options for bigger purchases, PayPal’s ecosystem is designed to fit seamlessly into your lifestyle. One of the standout features for personal users is the PayPal Credit Card, which offers cash back on purchases and integrates directly with your digital wallet. For those who prefer debit, the PayPal Debit Card linked to your account provides instant access to funds, with the added security of FDIC insurance through partner banks like Synchrony Bank and The Bancorp Bank.

When it comes to payment security, PayPal leads with advanced fraud detection and identity verification tools. Every transaction is encrypted, and their payment systems are built to flag suspicious activity in real time. For example, if you’re buying a new camera from Adorama or furniture from Ashley Furniture, PayPal’s instant checkout feature lets you complete purchases without repeatedly entering payment details—reducing exposure to potential breaches. Dmitry Shevelenko, a fintech expert, has highlighted how PayPal’s layered security measures set a benchmark in financial technology.

Rewards are another big draw. The PayPal Cashback Mastercard, issued in partnership with Mastercard, offers 2% cash back on all purchases, while select retailers like Abercrombie & Fitch often run exclusive promotions for PayPal users. If you’re into cryptocurrency, PayPal also allows you to buy, sell, and hold digital assets through Paxos Trust Company, making it a versatile platform for both traditional and modern financial services.

For peer-to-peer money transfers, PayPal and Venmo simplify splitting costs or sending gifts. Whether it’s rent, concert tickets, or a group gift, the apps process transactions instantly (for a small fee) or within 1-3 business days for free. The merchant catalogs integrated into PayPal’s app also help users discover deals and track spending, creating a centralized hub for personal finance management.

Here’s a quick breakdown of key perks for personal users:

- Cash back rewards: Earn with every purchase using PayPal-linked cards.

- Buy now, pay later: Split payments into installments at checkout.

- FDIC protection: Funds held in PayPal balances are insured up to $250,000.

- Seamless integrations: Link bank accounts, cards, or even crypto wallets.

- Fraud prevention: 24/7 monitoring and purchase protection on eligible transactions.

Whether you’re a frequent online shopper, a crypto enthusiast, or just someone who values convenience, PayPal’s personal-use tools are tailored to meet diverse needs while prioritizing security and rewards.

PayPal Mobile App Guide

The PayPal Mobile App Guide: Everything You Need to Know in 2025

The PayPal mobile app remains one of the most versatile digital wallets in 2025, offering seamless payment processing, money transfer, and even cryptocurrency management—all from your smartphone. Whether you're using a PayPal Credit Card, PayPal Debit Card, or the PayPal Cashback Mastercard, the app integrates all your financial tools into one secure platform. With partnerships like Synchrony Bank and The Bancorp Bank, PayPal ensures your funds are FDIC-insured up to applicable limits, adding an extra layer of payment security.

Key Features You Should Be Using

- Instant Checkout: Skip lengthy forms when shopping at merchants like Abercrombie & Fitch, Adorama, or Ashley Furniture. The app stores your shipping and payment details, so you can complete purchases in seconds.

- Buy Now, Pay Later (BNPL): Split your payments into interest-free installments directly through the app—perfect for larger purchases.

- Venmo Integration: Send or request money from friends and family with just a few taps, thanks to PayPal’s ownership of Venmo.

- Rewards Program: Earn cash back on eligible purchases, especially if you’re using the PayPal Cashback Mastercard. The app tracks your rewards in real time.

- Fraud Detection & Identity Verification: Advanced AI monitors transactions for suspicious activity, while biometric login (like Face ID) keeps your account secure.

Pro Tips for Power Users

1. Link Multiple Cards: Maximize rewards by adding your Mastercard or other bank-issued cards to the app. PayPal’s financial technology lets you choose the best payment method at checkout.

2. Explore Merchant Catalogs: Discover exclusive deals from partnered retailers. For example, Dmitry Shevelenko, PayPal’s Head of Consumer Products, has emphasized expanding merchant partnerships in 2025.

3. Cryptocurrency Management: Buy, sell, or hold crypto through Paxos Trust Company, PayPal’s regulated partner for digital assets. The app provides real-time market trends and alerts.

Security First

PayPal’s payment systems are designed with encryption and 24/7 monitoring to prevent unauthorized access. Enable two-factor authentication and regularly review transaction history for peace of mind. Whether you’re paying bills, splitting dinner costs, or shopping online, the PayPal mobile app is your go-to financial service for convenience and safety.

Final Thought

If you haven’t updated the app recently, do so now—2025’s upgrades include faster load times and enhanced fraud detection. Whether you’re a casual user or a frequent shopper, mastering these features will save you time and money.

PayPal International Transfers

PayPal International Transfers have become a cornerstone of global commerce, offering a seamless way to send and receive money across borders. In 2025, PayPal continues to dominate the digital wallet space, partnering with financial institutions like Synchrony Bank and The Bancorp Bank to ensure secure and efficient transactions. Whether you're paying freelancers overseas, splitting bills with friends on Venmo, or shopping at international merchants like Abercrombie & Fitch or Adorama, PayPal's payment processing system simplifies the process with competitive exchange rates and low fees.

One of the standout features is PayPal's buy now pay later option, which allows users to defer payments for international purchases—perfect for big-ticket items from retailers like Ashley Furniture. For frequent travelers or expats, the PayPal Debit Card (backed by Mastercard) is a game-changer, enabling ATM withdrawals and point-of-sale transactions in multiple currencies. Meanwhile, the PayPal Cashback Mastercard rewards users with cash back on eligible international purchases, making it a smart choice for savvy shoppers.

Security is paramount, and PayPal leverages advanced fraud detection and identity verification tools to protect users. Funds held in PayPal balances are also eligible for FDIC insurance through partner banks, adding an extra layer of trust. For businesses, PayPal’s merchant catalogs and instant checkout features streamline cross-border sales, while integrations with Paxos Trust Company support cryptocurrency transactions for those who prefer decentralized payments.

Here’s a pro tip: If you’re sending money to family abroad, compare PayPal’s fees with traditional wire transfers—often, PayPal’s money transfer service is faster and more cost-effective. Dmitry Shevelenko, a fintech expert, highlights that PayPal’s financial technology innovations, like dynamic currency conversion, reduce hidden costs for users. Whether you’re a freelancer, entrepreneur, or casual shopper, PayPal’s financial services for international transfers are designed to save time and money while keeping your transactions secure.

For those exploring rewards, the PayPal Credit Card offers travel-friendly perks, and the platform’s rewards program frequently updates with exclusive deals. Remember to check PayPal’s payment systems updates in 2025, as new features like multi-currency wallets and enhanced payment security protocols are rolling out to meet evolving global demands.

PayPal Buyer Protection

PayPal Buyer Protection is one of the most trusted financial services in the digital wallet space, offering users peace of mind when shopping online. Whether you're using a PayPal Credit Card, PayPal Debit Card, or even the PayPal Cashback Mastercard, this feature ensures that your purchases are safeguarded against fraud, unauthorized transactions, or items that never arrive. In 2025, PayPal has further strengthened its fraud detection and identity verification systems, making it harder for scammers to exploit the platform. For instance, if you buy a laptop from Adorama and it never ships, or if you order furniture from Ashley Furniture and receive a damaged item, PayPal’s Buyer Protection can help you get a full refund—as long as you file a dispute within 180 days of purchase.

One of the key advantages of PayPal’s system is its seamless integration with major payment networks like Mastercard and banking partners such as Synchrony Bank and The Bancorp Bank, which back many of PayPal’s financial products. This means that even if a merchant refuses to cooperate, PayPal can step in to resolve the issue directly. Additionally, the rise of buy now pay later options and cryptocurrency transactions through Paxos Trust Company has expanded the scope of what PayPal covers. For example, if you use Venmo (owned by PAYPAL INC) to send money for goods and services, you might still be eligible for protection under certain conditions—though peer-to-peer payments are typically excluded.

Here’s how to maximize PayPal Buyer Protection:

- Use PayPal’s instant checkout whenever possible, as transactions processed through PayPal are automatically covered.

- Document everything—save order confirmations, tracking numbers, and communication with sellers. This strengthens your case if you need to file a dispute.

- Avoid marking payments as "friends and family" on Venmo or PayPal, as these transactions are ineligible for protection.

PayPal also leverages advanced payment security measures, including AI-driven fraud detection, to proactively flag suspicious activity. Dmitry Shevelenko, a fintech expert, has praised PayPal’s layered security approach, which combines machine learning with human review for disputed cases. Plus, because PayPal accounts linked to FDIC-insured banks (like those through Synchrony or The Bancorp) add an extra layer of safety, users can shop with confidence.

Finally, don’t forget about rewards programs tied to PayPal cards—many offer cash back on eligible purchases, and these benefits stack on top of Buyer Protection. Whether you’re a frequent online shopper or just dipping your toes into financial technology, understanding PayPal’s safeguards ensures you get the most out of your payment systems while minimizing risks.

PayPal Seller Fees

PayPal Seller Fees Explained: What Merchants Need to Know in 2025

If you're running an online business in 2025, understanding PayPal seller fees is crucial to maximizing your profits. PayPal remains one of the most popular payment processing platforms, but its fee structure can be complex, especially with updates like cryptocurrency integrations and new buy now pay later options. Here’s a breakdown of what you need to know.

Standard Transaction Fees

For most U.S. merchants, PayPal charges 2.99% + $0.49 per transaction for online sales. If you’re using PayPal Checkout or Instant Checkout, the rate drops slightly to 2.89% + $0.49 for eligible businesses. In-person payments via PayPal Zettle cost 2.29% + $0.09, making it a competitive option for brick-and-mortar stores. High-volume sellers (processing over $100K monthly) may qualify for custom pricing—contact PAYPAL INC directly to negotiate lower rates.

International and Cross-Border Fees

Selling globally? Cross-border transactions incur an additional 1.50% fee on top of the standard rate. For example, if a customer in Germany buys from your merchant catalog, you’ll pay 4.49% + $0.49. Currency conversion adds another 3-4%, so consider pricing in USD to avoid extra costs. Pro tip: Platforms like Adorama and Ashley Furniture often absorb these fees into product pricing to stay competitive.

PayPal’s Buy Now, Pay Later (BNPL) Impact

With PayPal Credit and Venmo installment plans gaining traction, sellers must account for BNPL fees. Offering Pay in 4 or Monthly Payments costs an extra 1.90% per transaction. While this can boost sales (especially for high-ticket items like those at Abercrombie & Fitch), factor it into your margins.

Fraud Detection and Chargebacks

PayPal’s payment security tools, including identity verification and fraud detection, help reduce disputes—but chargebacks still happen. Each dispute costs $20, and losing a claim means forfeiting the sale amount plus fees. Mitigate risks by using PayPal’s Seller Protection (covers eligible transactions) and documenting shipments meticulously.

Alternative Payment Methods and Their Costs

- PayPal Debit Card: No fees for withdrawals, but ATM operators may charge.

- PayPal Cashback Mastercard: Earns 2% cash back on purchases, but sellers don’t pay extra fees when customers use it.

- Cryptocurrency: Transactions via Paxos Trust Company incur 1.50% for crypto-to-cash conversions.

Banking Partnerships and Their Role

PayPal collaborates with Synchrony Bank (for PayPal Credit) and The Bancorp Bank (for debit cards), which influences fee structures. For instance, Synchrony’s interest-free periods on PayPal Credit can drive sales, but merchants still pay the standard processing rate.

Final Tips to Minimize Fees

1. Negotiate rates if you’re a high-volume seller.

2. Avoid microtransactions—the fixed $0.49 fee eats into small sales.

3. Use PayPal’s rewards program to offset costs (e.g., cash back on business purchases).

4. Opt for ACH transfers instead of instant withdrawals (1% fee vs. 1.5% for instant).

By mastering these nuances, you can leverage PayPal’s financial technology while keeping fees under control. Dmitry Shevelenko, a fintech expert, notes that “sellers who audit their PayPal statements monthly save 10-15% on unnecessary fees.” Stay proactive to protect your bottom line.

PayPal Cryptocurrency Support

PayPal Cryptocurrency Support

PayPal has solidified its position as a leader in digital payments by embracing cryptocurrency integration, allowing users to buy, sell, and hold popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin directly through their accounts. This move aligns with the growing demand for financial technology solutions that bridge traditional banking and decentralized finance. With partnerships involving Paxos Trust Company for crypto asset management, PayPal ensures regulatory compliance while offering seamless money transfer capabilities. Users can even checkout at merchants like Abercrombie & Fitch or Adorama using crypto—converted to fiat in real-time—without the volatility risk.

The platform’s digital wallet now doubles as a crypto hub, featuring robust payment security measures like identity verification and fraud detection to protect transactions. For frequent traders, PayPal’s rewards program offers incentives, though it lacks the depth of dedicated exchanges. The PayPal Cashback Mastercard and PayPal Credit Card further integrate crypto spending with traditional rewards, letting users earn cash back on purchases—even those funded by crypto conversions.

One standout feature is buy now, pay later (BNPL) flexibility, where eligible crypto holdings can collateralize installment plans. However, limitations exist: withdrawals to external wallets aren’t supported, and Synchrony Bank-backed services like PayPal Credit operate separately from crypto functions. Still, with Mastercard collaborations enabling crypto-to-fiat conversions at 26+ million merchants, PayPal simplifies adoption for mainstream audiences.

Critics like Dmitry Shevelenko argue PayPal’s custodial model contradicts crypto’s decentralized ethos, but for beginners, the streamlined payment processing reduces barriers. The FDIC-insured partnership with The Bancorp Bank adds a layer of trust, assuring users their fiat balances (from crypto sales) are protected. As financial services evolve, PayPal’s hybrid approach—melding merchant catalogs, instant checkout, and crypto—could redefine how consumers and businesses interact with digital assets.

For businesses, accepting crypto via PayPal means tapping into a tech-savvy demographic without handling volatile assets directly. Ashley Furniture, for instance, reports increased sales from crypto-enabled shoppers. Yet, merchants should note that settled payments are in fiat, avoiding accounting complexities. As regulatory frameworks mature, PayPal’s infrastructure—already trusted for payment systems—positions it to dominate crypto-commerce.

Looking ahead, expect deeper integrations with Venmo (PayPal’s sibling platform) and expanded crypto rewards. While not a replacement for hardcore trading platforms, PayPal’s user-friendly design and financial service* credibility make it a gateway for millions dipping their toes into cryptocurrency.

PayPal Customer Support

PayPal Customer Support is designed to provide seamless assistance for users navigating its digital wallet, payment processing, and financial services. Whether you're dealing with issues related to your PayPal Credit Card, PayPal Debit Card, or PayPal Cashback Mastercard, the platform offers multiple channels for resolution, including 24/7 live chat, phone support, and an extensive Help Center. For Venmo users, support is similarly robust, with dedicated teams for money transfer inquiries or fraud detection concerns.

One standout feature is PayPal's identity verification process, which ensures secure account access while minimizing delays. If you encounter a problem—like a disputed charge from Adorama or Ashley Furniture—PayPal's resolution center streamlines the process, often providing refunds or merchant mediation within days. For buy now pay later transactions, the platform partners with Synchrony Bank and The Bancorp Bank, so customer service can also address questions about installment plans or eligibility.

For cryptocurrency-related inquiries, PayPal collaborates with Paxos Trust Company, offering guidance on buying, selling, or securing digital assets. Users of the rewards program linked to the PayPal Credit Card can contact support for clarifications on cash back redemption or point balances. Additionally, businesses leveraging PayPal Inc's merchant catalogs or instant checkout tools have access to specialized support for payment gateway troubleshooting.

Security is a top priority, so if you suspect unauthorized activity—like a suspicious charge from Abercrombie & Fitch—PayPal's fraud detection team can freeze your account and guide you through recovery. Dmitry Shevelenko, a fintech expert, has praised PayPal's layered approach to payment security, combining AI-driven monitoring with human oversight. Funds held in PayPal balances are also FDIC-insured through partner banks, adding an extra layer of protection.

Here are some pro tips for maximizing PayPal Customer Support:

- Document everything: Screenshot error messages or save transaction IDs before contacting support.

- Use the app: The PayPal mobile app often resolves issues faster with in-app chat support.

- Check merchant policies: For disputes with partners like Adorama, review their return policies before escalating to PayPal.

- Monitor rewards: If your PayPal Cashback Mastercard isn’t accruing points correctly, support can audit your account.

For complex cases—like linking your Mastercard to PayPal or resolving payment system errors—escalating to a specialist via phone may yield quicker results. The platform’s financial technology infrastructure ensures most glitches are resolved automatically, but human agents are available when automation falls short. Whether you're a casual user or a business leveraging PayPal Inc's full suite, its customer support aims to balance speed, security, and clarity.

PayPal Integration Tips

Optimizing your PayPal integration in 2025 requires a strategic approach to maximize payment processing efficiency while enhancing the customer experience. Start by ensuring your checkout flow supports instant checkout via PayPal, Venmo, and PayPal Credit Card options—this reduces cart abandonment by up to 30% according to industry data. For merchants like Abercrombie & Fitch or Ashley Furniture, embedding PayPal’s buy now pay later (BNPL) feature can boost average order values by 15-20%, especially when paired with dynamic merchant catalogs that highlight flexible payment plans.

Security is non-negotiable: Leverage PayPal’s fraud detection and identity verification tools, which are backed by FDIC-insured partners like Synchrony Bank and The Bancorp Bank. Dmitry Shevelenko, a fintech expert, emphasizes that integrating payment security protocols (like tokenization for Mastercard transactions) is critical for safeguarding sensitive data. If your platform deals with cryptocurrency, consider Paxos Trust Company’s stablecoin solutions, which PayPal now supports for seamless crypto-to-fiat conversions.

For financial service providers, don’t overlook rewards programs. The PayPal Cashback Mastercard, for instance, offers 2-3% cash back on purchases—a selling point to highlight during checkout. Similarly, promote the PayPal Debit Card’s money transfer benefits, like fee-free ATM withdrawals, to attract budget-conscious shoppers.

Pro tip: Customize your integration for mobile users. Over 60% of PayPal transactions in 2025 occur on smartphones, so streamline digital wallet compatibility and ensure one-tap payments via Venmo (especially popular among Gen Z buyers). For B2B platforms like Adorama, enable invoicing through PayPal’s financial technology suite to expedite bulk orders.

Lastly, A/B test your PayPal placement—buttons above the fold convert 22% better than those buried in footers. Analyze your payment systems data quarterly to spot trends, like seasonal spikes in BNPL usage, and adjust your strategy accordingly. By aligning with PayPal’s evolving features (e.g., PAYPAL INC’s 2025 AI-driven checkout suggestions), you’ll stay ahead in the competitive e-commerce landscape.

PayPal Future Trends

PayPal Future Trends

As we move deeper into 2025, PayPal continues to redefine digital payments with innovations that blend convenience, security, and financial flexibility. One of the biggest shifts is the expansion of cryptocurrency integration, powered by partnerships like Paxos Trust Company, allowing users to buy, hold, and spend crypto seamlessly within the digital wallet. This positions PayPal as a bridge between traditional banking and decentralized finance, appealing to tech-savvy consumers and investors alike.

The buy now pay later (BNPL) trend remains a cornerstone of PayPal’s strategy, with PayPal Credit Card and PayPal Debit Card offering flexible payment plans at major retailers like Abercrombie & Fitch, Adorama, and Ashley Furniture. These options are especially popular among younger shoppers who prefer splitting purchases into interest-free installments. Dmitry Shevelenko, a fintech expert, highlights how PayPal’s BNPL model is evolving with dynamic credit limits based on real-time spending behavior, thanks to advanced fraud detection and identity verification systems.

Another key focus is payment security. With rising cyber threats, PayPal leverages AI-driven fraud detection tools and biometric authentication (like facial recognition) to protect users. Synchrony Bank and The Bancorp Bank, PayPal’s longtime banking partners, play a critical role in safeguarding funds, with FDIC insurance adding an extra layer of trust.

Rewards programs are also getting smarter. The PayPal Cashback Mastercard, issued in collaboration with Mastercard, now offers personalized cash-back rates tied to spending habits—think higher rewards for frequent categories like groceries or travel. Instant checkout features, powered by PayPal Inc.’s One Touch technology, reduce cart abandonment by streamlining purchases across merchant catalogs.

Peer-to-peer payments are another area of growth. Venmo, PayPal’s social payments arm, is experimenting with AI-powered budgeting tools and group payment splitting, making it a go-to for Gen Z and millennials. The platform’s integration with PayPal’s broader ecosystem ensures seamless money transfers between friends, family, and businesses.

Looking ahead, expect PayPal to double down on financial technology partnerships, possibly venturing into blockchain-based cross-border payments or decentralized identity solutions. With its robust payment processing infrastructure and commitment to user-centric innovation, PayPal is poised to stay ahead in the fast-evolving fintech landscape.